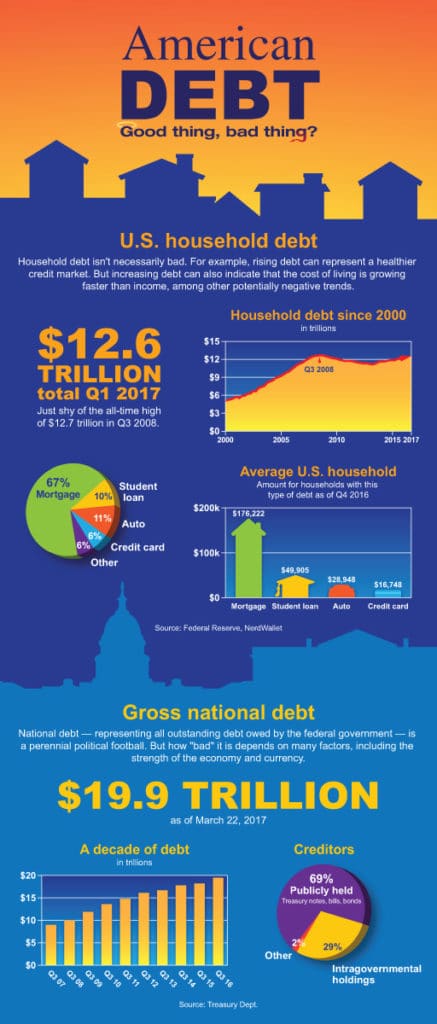

American Debt

Make sure the IRS won’t consider your business to be a “hobby”

If you run a business “on the side” and derive most of your income from another source (whether from another business you own, employment or investments), you may face a peculiar risk: Under certain circumstances, this on-the-side business might not be a business at all in the eyes of the IRS. It may be […]

Who can — and who should — take the American Opportunity credit?

If you have a child in college, you may be eligible to claim the American Opportunity credit on your 2016 income tax return. If, however, your income is too high, you won’t qualify for the credit — but your child might. There’s one potential downside: If your dependent child claims the credit, you must […]

Offer plan loans? Be sure to set a reasonable interest rate

Like many businesses, yours may allow retirement plan participants to take out loans from their accounts. Such loans are governed by many IRS and Department of Labor (DOL) rules and regulations. So if your company offers plan loans, your plan document must comply with current laws — including setting a “reasonable” interest rate. Agency […]

Direct tuition payments benefit your grandchild and your estate plan

Grandparents often want to play a role in financing their grandchildren’s education. If you’re one of them, it’s important to consider the impact that different financing options will have on your estate plan. Make direct tuition payments A simple but effective technique is to make tuition payments on behalf of your grandchild. So long as […]

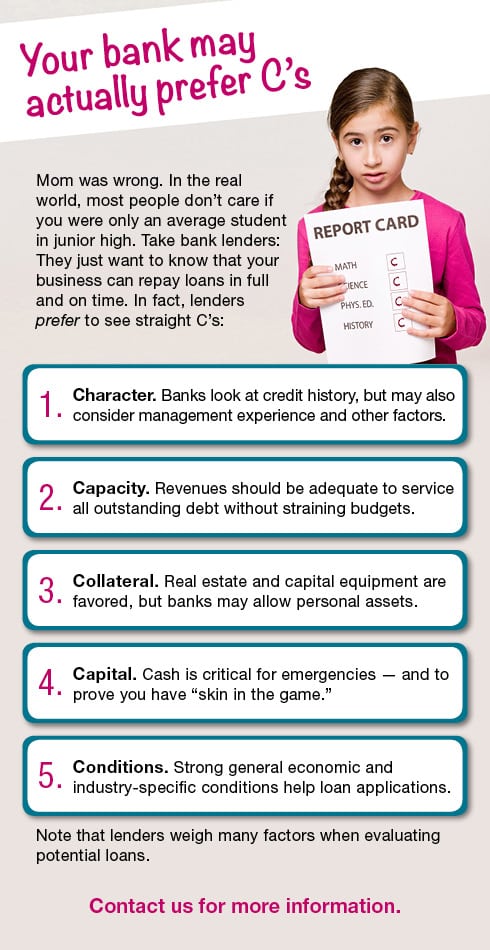

Your bank may actually prefer C’s

Save the Date!

Divorce necessitates an estate plan review

There are few events that can completely upend a person’s life more than divorce. Of course, there’s the emotional toll on you and your family to contend with, but you also have to consider the divorce’s impact on your estate plan. When you originally crafted your plan, you likely centered many of its strategies […]

The Section 1031 exchange: Why it’s such a great tax planning tool

Like many business owners, you might also own highly appreciated business or investment real estate. Fortunately, there’s an effective tax planning strategy at your disposal: the Section 1031 “like kind” exchange. It can help you defer capital gains tax on appreciated property indefinitely. How it works Section 1031 of the Internal Revenue Code allows […]

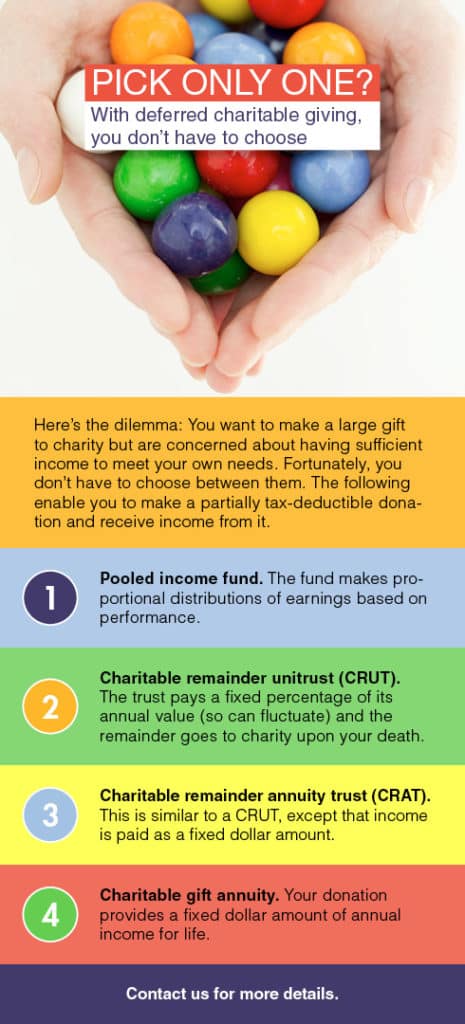

PICK ONLY ONE!