Signs of inventory fraud

Is your inventory being stolen by dishonest employees or customers? Inventory is a prime target for fraud schemes, second only to cash. And it doesn’t always involve the physical theft of items. Here are some early warning signs that your inventory has been targeted. Know your risk profile Some companies are more at risk […]

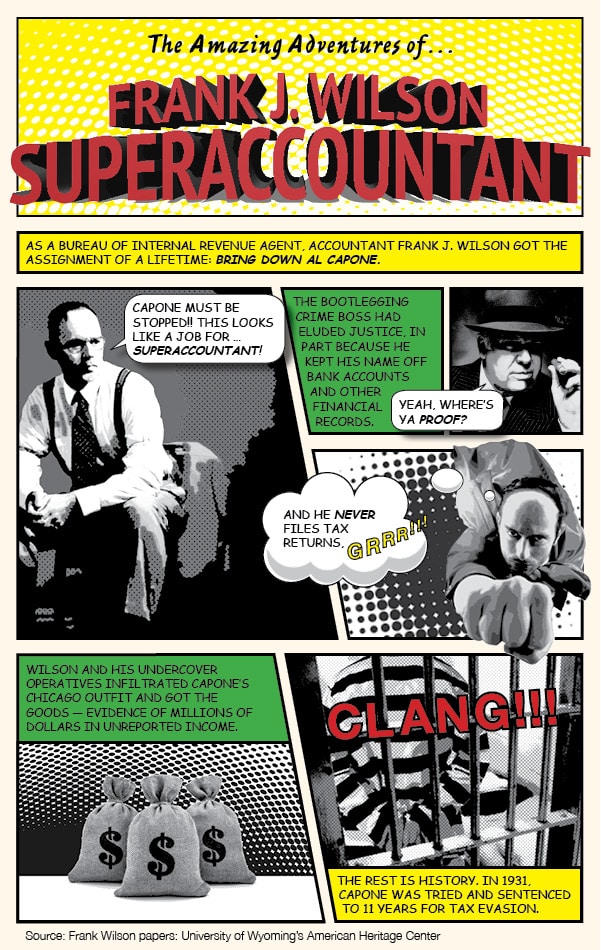

The Amazing Adventures of Frank J. Wilson Super Accountant

A brief overview of the President-elect’s tax plan for individuals

Now that Donald Trump has been elected President of the United States and Republicans have retained control of both chambers of Congress, an overhaul of the U.S. tax code next year is likely. President-elect Trump’s tax reform plan, released earlier this year, includes the following changes that would affect individuals: • Reducing the number […]

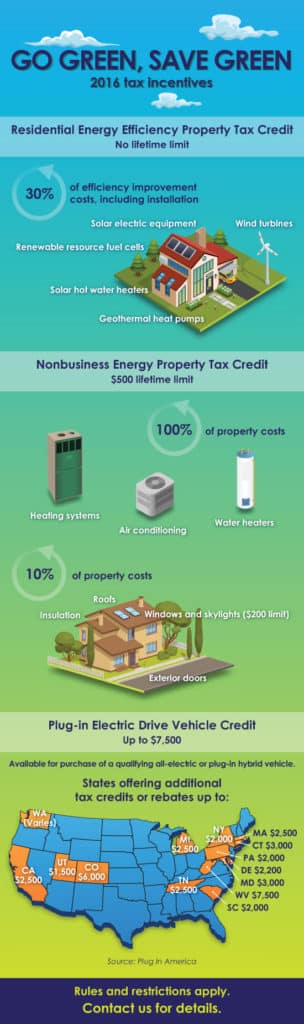

Go Green, Save Green

Installment sales offer both tax pluses and tax minuses

Whether you’re selling your business or acquiring another company, the tax consequences can have a major impact on the transaction’s success or failure. Consider installment sales, for example. The sale of a business might be structured as an installment sale if the buyer lacks sufficient cash or pays a contingent amount based on the […]

Are you coordinating your income tax planning with your estate plan?

Until recently, estate planning strategies typically focused on minimizing federal gift and estate taxes, such as by giving away assets during life to reduce the taxable estate. Today, however, the focus has moved toward income taxes, making the coordination of income tax planning and estate planning more important. Why the change? Since 2001, the […]

Are you timing business income and expenses to your tax advantage?

Typically, it’s better to defer tax. One way is through controlling when your business recognizes income and incurs deductible expenses. Here are two timing strategies that can help businesses do this: Defer income to next year. If your business uses the cash method of accounting, you can defer billing for your products or services. […]

A quick look at the President-elect’s tax plan for businesses

The election of Donald Trump as President of the United States could result in major tax law changes in 2017. Proposed changes spelled out in Trump’s tax reform plan released earlier this year that would affect businesses include: • Reducing the top corporate income tax rate from 35% to 15%, • Abolishing the corporate […]

How’d you like a $500,000 deduction – expedited?

The wrong life insurance beneficiary can wreak havoc with your estate plan

Life insurance can be a powerful financial and estate planning tool, but its benefits may be reduced or even eliminated if you designate the wrong beneficiary or fail to change beneficiaries when your circumstances change. Here are common pitfalls to avoid: Naming your estate as beneficiary. Doing so subjects life insurance proceeds to unnecessary […]