Deduction for state and local sales tax benefits some, but not all, taxpayers

The break allowing taxpayers to take an itemized deduction for state and local sales taxes in lieu of state and local income taxes was made “permanent” a little over a year ago. This break can be valuable to those residing in states with no or low income taxes or who purchase major items, such […]

The Father of Cost Accounting

Withhold tax from my paycheck?

Can you defer taxes on advance payments?

Many businesses receive payment in advance for goods and services. Examples include magazine subscriptions, long-term supply contracts, organization memberships, computer software licenses and gift cards. Generally, advance payments are included in taxable income in the year they’re received, even if you defer a portion of the income for financial reporting purposes. But there are […]

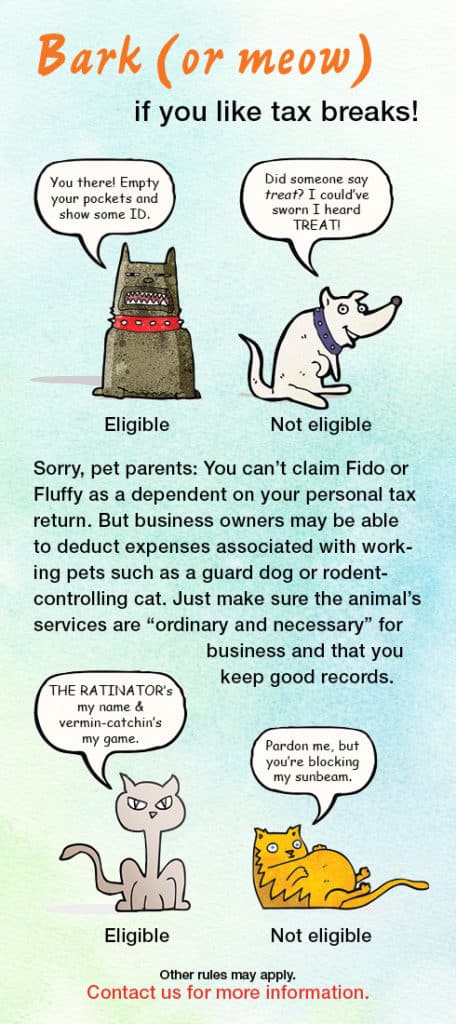

Bark (or meow) if you like tax breaks!

Help prevent tax identity theft by filing early

If you’re like many Americans, you might not start thinking about filing your tax return until close to this year’s April 18 deadline. You might even want to file for an extension so you don’t have to send your return to the IRS until October 16. But there’s another date you should keep in […]

Should you set up trusts in a more “trust-friendly” state?

While it’s natural to set up trusts in the state where you live, you may be losing out on significant benefits available in more “trust-friendly” states. For example, some states: • Don’t tax trust income, • Authorize domestic asset protection trusts, which provide added protection against creditors’ claims, • Permit silent trusts, under which […]

Succession planning and estate planning must go hand in hand

As the saying goes, nothing lasts forever — and that goes for most companies. Then again, with the right succession plan in place, you can do your part to ensure your business continues down a path of success for at least another generation. From there, it will be your successor’s job to propel it […]

What is a business?

Differentiating the purchase of a business from the purchase of a group of assets is something that the Financial Accounting Standards Board (FASB) has been debating for years. In January 2017, the board finally published guidance to help financial executives and accountants define what a business is in the context of a business combination. […]