An EAP can keep your top players on the floor

A good basketball team is at its best when its top players are on the floor. Similarly, a company is the most productive, efficient and innovative when its best employees are in the right positions, doing great work. Unfortunately, it’s not uncommon for good employees to battle personal problems, such as substance dependence, financial […]

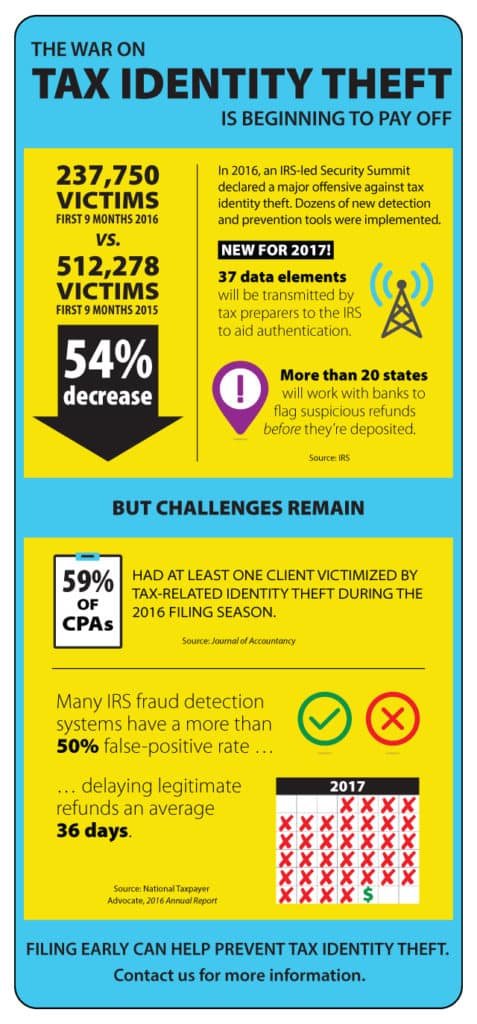

The War on Tax Identity Theft

SEPs: A powerful retroactive tax planning tool

Simplified Employee Pensions (SEPs) are sometimes regarded as the “no-brainer” first choice for high-income small-business owners who don’t currently have tax-advantaged retirement plans set up for themselves. Why? Unlike other types of retirement plans, a SEP is easy to establish and a powerful retroactive tax planning tool: The deadline for setting up a SEP […]

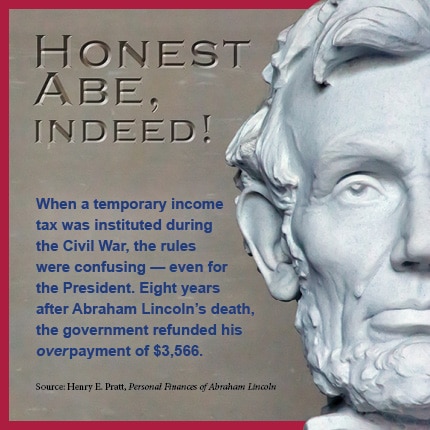

Honest, Abe, Indeed!

Do you need to file a 2016 gift tax return by April 18?

Last year you may have made significant gifts to your children, grandchildren or other heirs as part of your estate planning strategy. Or perhaps you just wanted to provide loved ones with some helpful financial support. Regardless of the reason for making a gift, it’s important to know under what circumstances you’re required to file […]

2016 charitable deductions: Substantiate them or lose them

Sharing your wealth with a favorite charity can benefit those in need and reduce your taxable estate. In addition, your donations can ease your income tax liability. But you must meet IRS substantiation requirements. If you fail to do so, the IRS could deny the corresponding deductions you’re claiming. Let’s take a look at the […]

Envision your advisory board before you form it

Many companies reach a point in their development where they could benefit from an advisory board. It’s all too easy in today’s complex business world to get caught up in an “echo chamber” of ideas and perspectives that only originate internally. For many business owners, an understandable first question about the concept is: What […]

Is annual financial reporting enough?

Businesses generally issue year-end financial statements to let investors and lenders evaluate their financial health. But proactive stakeholders — including the company’s CEO and board of directors — may want more than one “snapshot” per year of financial results. Interim statements let stakeholders know how a company is doing each quarter or month, but […]