Tangible property safe harbors help maximize deductions

If last year your business made repairs to tangible property, such as buildings, machinery, equipment or vehicles, you may be eligible for a valuable deduction on your 2016 income tax return. But you must make sure they were truly “repairs,” and not actually “improvements.” Why? Costs incurred to improve tangible property must be depreciated […]

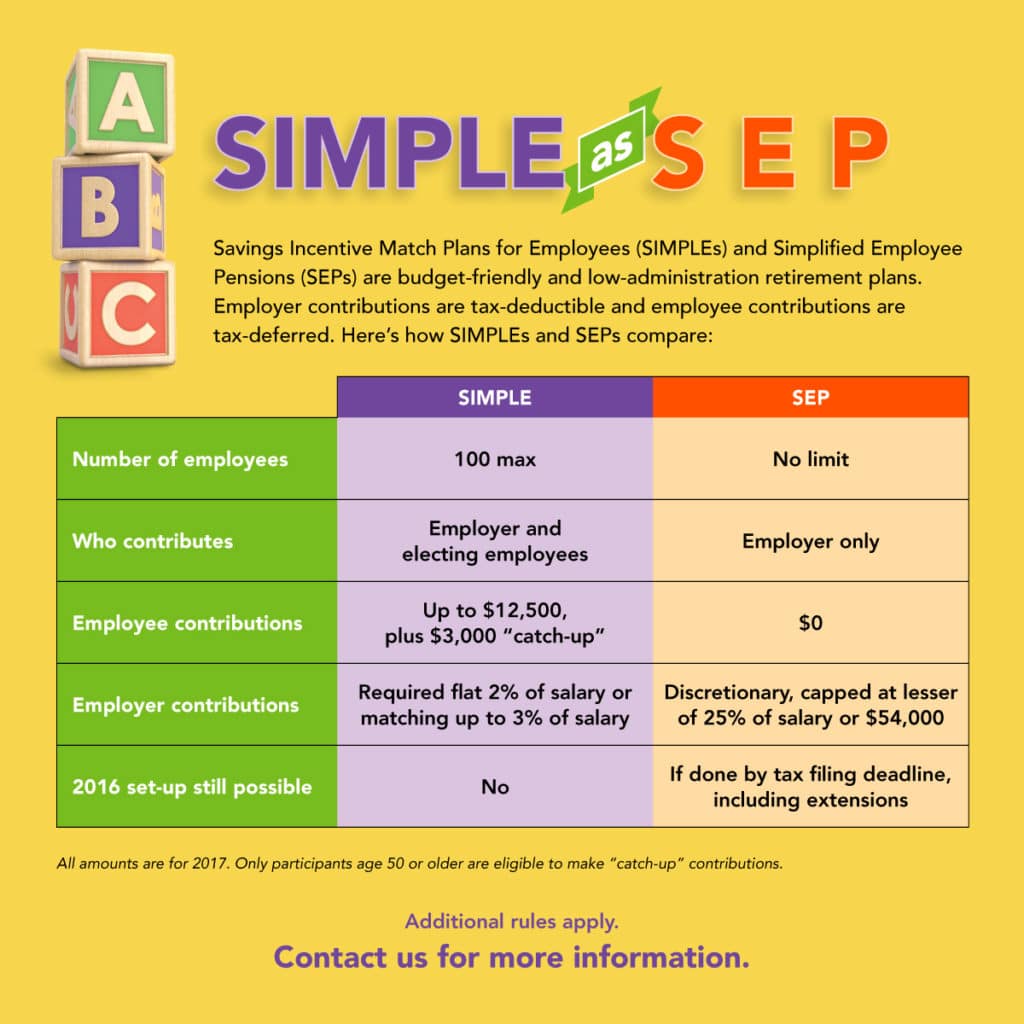

SIMPLE vs SEP

When it comes to charitable deductions, all donations aren’t created equal

As you file your 2016 return and plan your charitable giving for 2017, it’s important to keep in mind the available deduction. It can vary significantly depending on a variety of factors. What you give Other than the actual amount you donate, one of the biggest factors that can affect your deduction is what you […]

Use an ILIT as a wealth preserver

If you’re concerned about your family’s financial well-being after you’re gone, life insurance can provide peace of mind. Going a step further and setting up an irrevocable life insurance trust (ILIT) to hold the policy offers additional estate planning benefits. Asset protection If you’re concerned about your heirs’ money management skills, an ILIT may be […]

Don’t make hunches — crunch the numbers

Some business owners make major decisions by relying on gut instinct. But investments made on a “hunch” often fall short of management’s expectations. In the broadest sense, you’re really trying to answer a simple question: If my company buys a given asset, will the asset’s benefits be greater than its cost? The good news […]