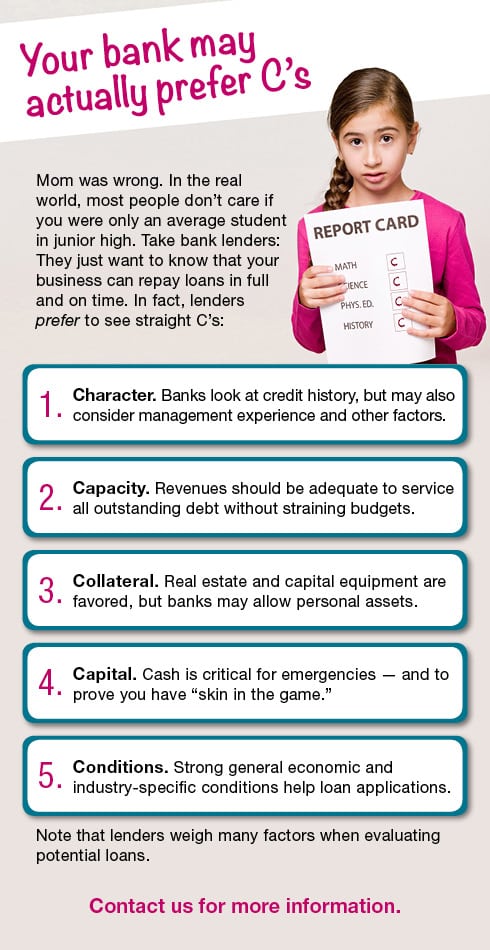

Your bank may actually prefer C’s

Save the Date!

Divorce necessitates an estate plan review

There are few events that can completely upend a person’s life more than divorce. Of course, there’s the emotional toll on you and your family to contend with, but you also have to consider the divorce’s impact on your estate plan. When you originally crafted your plan, you likely centered many of its strategies […]

The Section 1031 exchange: Why it’s such a great tax planning tool

Like many business owners, you might also own highly appreciated business or investment real estate. Fortunately, there’s an effective tax planning strategy at your disposal: the Section 1031 “like kind” exchange. It can help you defer capital gains tax on appreciated property indefinitely. How it works Section 1031 of the Internal Revenue Code allows […]

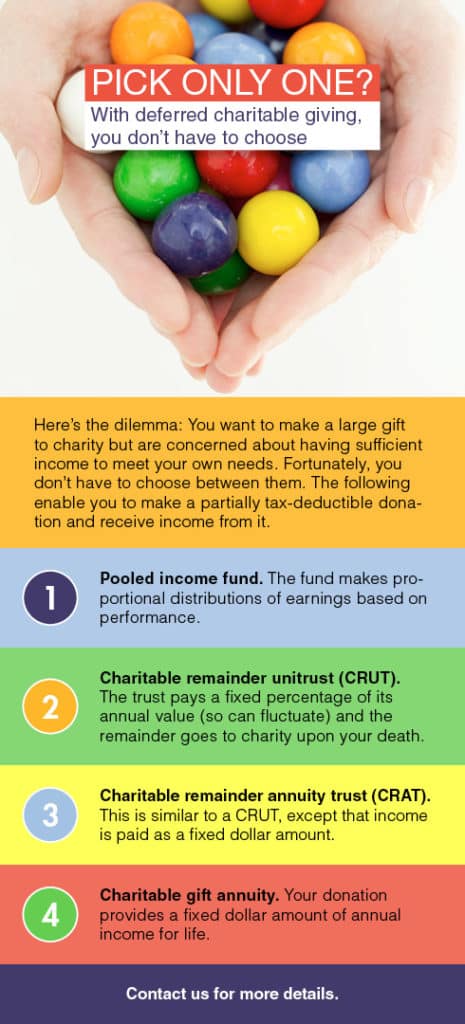

PICK ONLY ONE!

2016 IRA contributions — it’s not too late!

Yes, there’s still time to make 2016 contributions to your IRA. The deadline for such contributions is April 18, 2017. If the contribution is deductible, it will lower your 2016 tax bill. But even if it isn’t, making a 2016 contribution is likely a good idea. Benefits beyond a deduction Tax-advantaged retirement plans like IRAs […]

Keep family matters out of the public eye by avoiding probate

Although probate can be time consuming and expensive, perhaps its biggest downside is that it’s public — anyone who’s interested can find out what assets you owned and how they’re being distributed after your death. The public nature of probate can also draw unwanted attention from disgruntled family members who may challenge the disposition […]

Getting your money’s worth out of a company retreat

Company retreats can cost enormous amounts of time and money. Are they worth it? Sometimes. Large-scale get-togethers can involve considerable out-of-pocket costs. And if the retreat is poorly planned or executed, participants’ wasted time is the biggest expense. But a properly budgeted, planned and executed retreat can be hugely profitable, producing fresh ideas, renewed […]

Evaluating going concern issues

Financial statements are generally prepared under the assumption that the business will remain a “going concern.” That is, it’s expected to continue to generate a positive return on its assets and meet its obligations in the ordinary course of business. But sometimes conditions put that assumption into question. Recently, the responsibility for making going […]