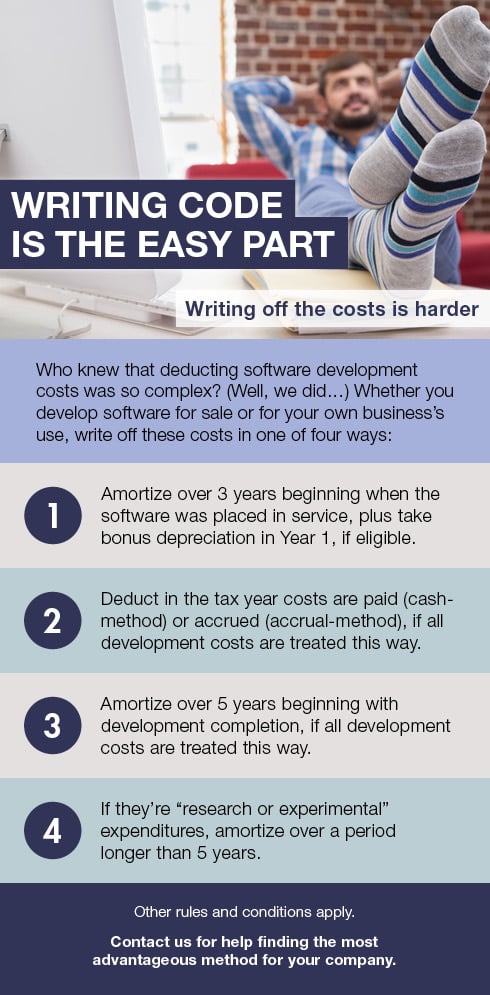

WRITING CODE IS THE EASY PART

Saving tax with home-related deductions and exclusions

Currently, home ownership comes with many tax-saving opportunities. Consider both deductions and exclusions when you’re filing your 2016 return and tax planning for 2017: Property tax deduction. Property tax is generally fully deductible — unless you’re subject to the alternative minimum tax (AMT). Mortgage interest deduction. You generally can deduct interest on up to […]

Be aware of the ins and outs of holding joint title to property

Owning assets jointly with one or more children or other heirs is a common estate planning “shortcut.” But like many shortcuts, it can produce unintended — and costly — consequences. Advantages There are two potential advantages to joint ownership: convenience and probate avoidance. If you hold title to property with a child as joint […]

Matchmaker, matchmaker: Choosing the right lender

It’s easy to think of lenders as doing your company a favor. But business financing relationships are just that: relationships. Yes, a lender has the working capital you need to grow. But a stable, successful business represents an enormously beneficial opportunity for the lender as well. So you should be just as picky with […]

Create a strong system of checks and balances

The Securities and Exchange Commission (SEC) requires public companies to evaluate and report on internal controls over financial reporting using a recognized control framework. Private companies generally aren’t required to use a framework for the oversight of internal controls, unless they’re audited, but a strong system of checks and balances is essential for them […]