Operating across state lines presents tax risks — or possibly rewards

It’s a smaller business world after all. With the ease and popularity of e-commerce, as well as the incredible efficiency of many supply chains, companies of all sorts are finding it easier than ever to widen their markets. Doing so has become so much more feasible that many businesses quickly find themselves crossing state […]

Choosing between a calendar tax year and a fiscal tax year

Many business owners use a calendar year as their company’s tax year. It’s intuitive and aligns with most owners’ personal returns, making it about as simple as anything involving taxes can be. But for some businesses, choosing a fiscal tax year can make more sense. What’s a fiscal tax year? A fiscal tax year […]

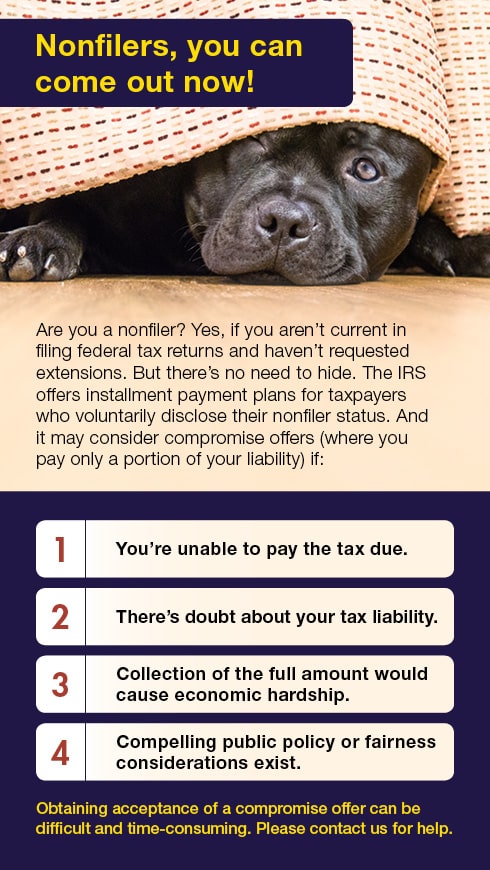

Nonfilers, you can come out now!

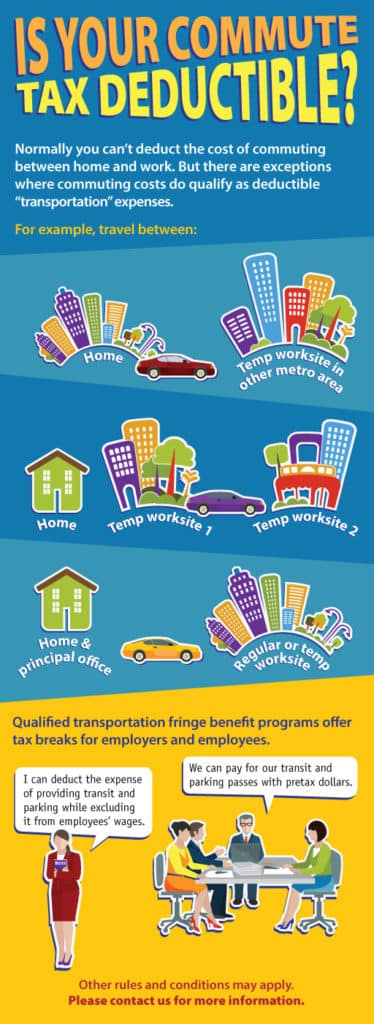

Is Your Commute Tax Deductible?

Want to help your child (or grandchild) buy a home? Don’t wait!

Mortgage interest rates are still at low levels, but they likely will increase as the Fed continues to raise rates. So if you’ve been thinking about helping your child — or grandchild — buy a home, consider acting soon. There also are some favorable tax factors that will help: 0% capital gains rate. If […]

Turning next year’s tax refund into cash in your pocket now

Each year, millions of taxpayers claim an income tax refund. To be sure, receiving a payment from the IRS for a few thousand dollars can be a pleasant influx of cash. But it means you were essentially giving the government an interest-free loan for close to a year, which isn’t the best use of your […]

Worried about challenges to your estate plan? Make it no contest

Estate planning is all about protecting your family and ensuring that your wealth is distributed according to your wishes. So the idea that someone might challenge your estate plan can be disconcerting. One strategy for protecting your plan is to include a “no-contest” clause in your will or revocable trust (or both). What’s a no-contest […]

Prepaid funeral plans may not provide peace of mind

The cost of a funeral has increased steadily during the past two decades. In fact, once all funeral-related costs are factored in, the typical traditional funeral service will cost an average family $8,000 to $10,000. To relieve their families of the burden of planning a funeral, many people plan their own and pay for them […]

Asset valuations and your estate plan go hand in hand

If your estate plan calls for making noncash gifts in trust or outright to beneficiaries, you need to know the values of those gifts and disclose them to the IRS on a gift tax return. For substantial gifts of noncash assets other than marketable securities, it’s a good idea to have a qualified appraiser value […]

Looking for concentration risks in your supply chain

Concentration risks are a threat to your supply chain. These occur when a company relies on a customer or supplier for 10% or more of its revenue or materials, or on several customers or suppliers located in the same geographic region. If a key customer or supplier experiences turmoil, the repercussions travel up or […]