Choosing the best way to reimburse employee travel expenses

If your employees incur work-related travel expenses, you can better attract and retain the best talent by reimbursing these expenses. But to secure tax-advantaged treatment for your business and your employees, it’s critical to comply with IRS rules. Reasons to reimburse While unreimbursed work-related travel expenses generally are deductible on a taxpayer’s individual tax […]

Consider the tax consequences before making an employee a partner

In today’s competitive environment, offering employees an equity interest in your business can be a powerful tool for attracting, retaining and motivating quality talent. If your business is organized as a partnership, however, there are some tax traps you should watch out for. Once an employee becomes a partner, you generally can no longer […]

Business owners: When it comes to IRS audits, be prepared

If you recently filed for your 2016 income tax return (rather than filing for an extension) you may now be wondering whether it’s likely that your business could be audited by the IRS based on your filing. Here’s what every business owner should know about the process. Catching the IRS’s eye Many business audits […]

Hire your children to save taxes for your business and your family

It can be difficult in the current job market for students and recent graduates to find summer or full-time jobs. If you’re a business owner with children in this situation, you may be able to provide them with valuable experience and income while generating tax savings for both your business and your family overall. […]

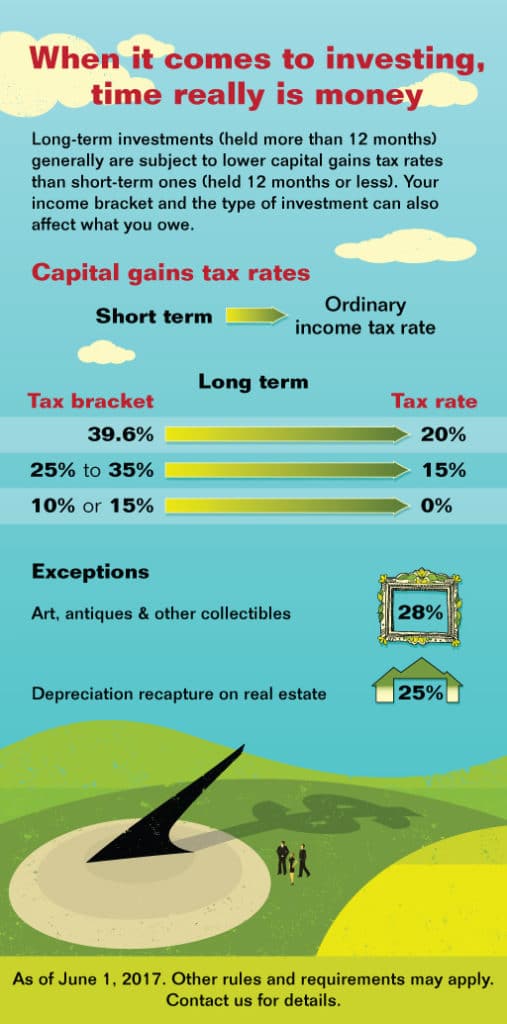

When it comes to investing, time really is money

Donating a vehicle might not provide the tax deduction you expect

All charitable donations aren’t created equal — some provide larger deductions than others. And it isn’t necessarily just how much or even what you donate that matters. How the charity uses your donation might also affect your deduction. Take vehicle donations, for example. If you donate your vehicle, the value of your deduction can vary […]

Coverdell ESAs: The tax-advantaged way to fund elementary and secondary school costs

With school letting out you might be focused on summer plans for your children (or grandchildren). But the end of the school year is also a good time to think about Coverdell Education Savings Accounts (ESAs) — especially if the children are in grade school or younger. One major advantage of ESAs over another popular […]

A “back door” Roth IRA can benefit higher-income taxpayers

A potential downside of tax-deferred saving through a traditional retirement plan is that you’ll have to pay taxes when you make withdrawals at retirement. Roth plans, on the other hand, allow tax-free distributions; the tradeoff is that contributions to these plans don’t reduce your current-year taxable income. Unfortunately, your employer might not offer a […]

Real estate investor vs. professional: Why it matters

Income and losses from investment real estate or rental property are passive by definition — unless you’re a real estate professional. Why does this matter? Passive income may be subject to the 3.8% net investment income tax (NIIT), and passive losses generally are deductible only against passive income, with the excess being carried forward. Of […]

A family bank professionalizes intrafamily lending

If you’re interested in lending money to your children or other family members, consider establishing a “family bank.” These entities enhance the benefits of intrafamily loans, while minimizing unintended consequences. Upsides and downsides of intrafamily lending Lending can be an effective way to provide your family financial assistance without triggering unwanted gift taxes. So long […]