Only certain trusts can own S corporation stock

S corporations must comply with several strict requirements or risk losing their tax-advantaged status. Among other things, they can have no more than 100 shareholders, can have no more than one class of stock and are permitted to have only certain types of shareholders. In an estate planning context, it’s critical that any trusts that […]

If you made gifts last year, you may (or may not) need to file a gift tax return

Gifting assets to loved ones is one of the simplest ways of reducing your taxable estate. However, what may not be as simple is determining whether you need to file a gift tax return (Form 709). With the April 17 filing deadline approaching, now is the time to find out an answer. Return required A […]

Business interruption insurance can help some companies

Natural disasters and other calamities can affect any company at any time. Depending on the type of business and its financial stability, a few weeks or months of lost income can leave it struggling to turn a profit indefinitely — or force ownership to sell or close. One way to guard against this predicament […]

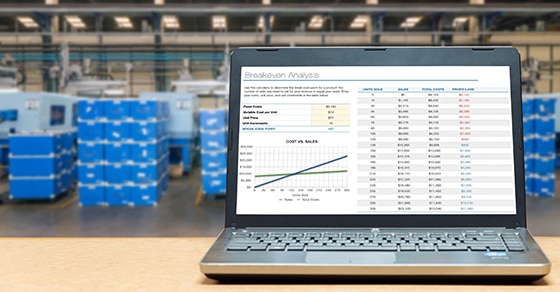

Fixed vs. variable costs: How to compute breakeven

Breakeven analysis can be useful when investing in new equipment, launching a new product or analyzing the effects of a cost reduction plan. The breakeven point is fairly easy to calculate using information from your company’s income statement. Here are the details. Analyzing your costs Breakeven can be explained in a few different ways. […]

Auditing work in progress

Financial statement auditors spend a lot of time evaluating how their clients report work in progress (WIP) inventory. Here’s why this account warrants special attention and how auditors evaluate whether WIP estimates seem reasonable. Accounting for inventory Companies must report the value of raw materials, WIP and finished goods on their balance sheets. WIP […]