ESOPs offer businesses tax and other benefits

With an employee stock ownership plan (ESOP), employee participants take part ownership of the business through a retirement savings arrangement. Meanwhile, the business and its existing owner(s) can benefit from some potential tax breaks, an extra-motivated workforce and potentially a smoother path for succession planning. How ESOPs work To implement an ESOP, you establish […]

Put your audit in reverse to save sales and use tax

It’s a safe bet that state tax authorities will let you know if you haven’t paid enough sales and use taxes, but what are the odds that you’ll be notified if you’ve paid too much? The chances are slim — so slim that many businesses use reverse audits to find overpayments so they can […]

Don’t overlook tax apportionment when planning your estate

If you expect your estate to have a significant estate tax liability at your death, be sure to include a well-thought-out tax apportionment clause in your will or revocable trust. An apportionment clause specifies how the estate tax burden will be allocated among your beneficiaries. Omission of this clause, or failure to word it carefully, […]

Own a vacation home? Adjusting rental vs. personal use might save taxes

Now that we’ve hit midsummer, if you own a vacation home that you both rent out and use personally, it’s a good time to review the potential tax consequences: If you rent it out for less than 15 days: You don’t have to report the income. But expenses associated with the rental (such as advertising […]

MOVING ON! NOT WITHOUT A BUSINESS SUCCESSION PLAN

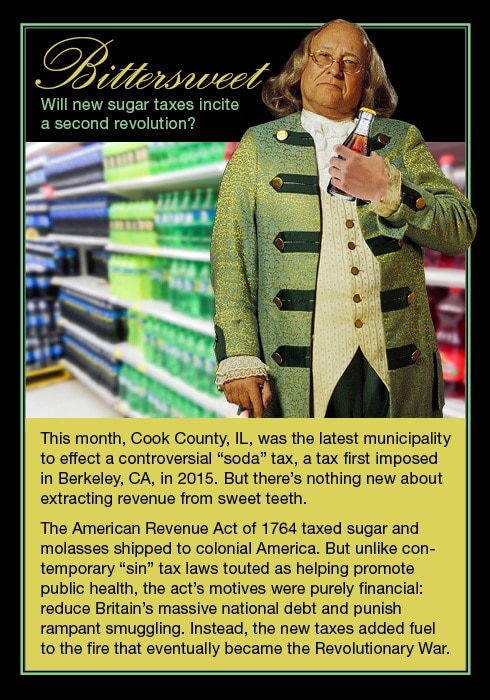

Bittersweet! Will new sugar taxes incite a second revolution?

Beware the GST tax when transferring assets to grandchildren

As you plan your estate, don’t overlook the generation-skipping transfer (GST) tax. Despite a generous $5.49 million GST tax exemption, complexities surrounding its allocation can create several tax traps for the unwary. GST basics The GST tax is a flat, 40% tax on transfers to “skip persons,” including grandchildren, other family members more than a […]

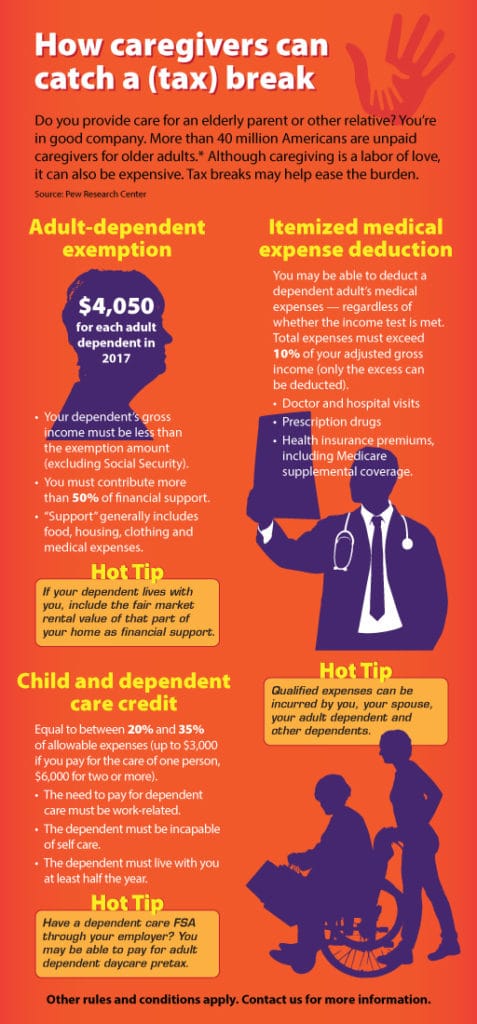

How caregivers can catch a (tax) break

Nonqualified stock options demand tax planning attention

Your compensation may take several forms, including salary, fringe benefits and bonuses. If you work for a corporation, you might also receive stock-based compensation, such as stock options. These come in two varieties: nonqualified (NQSOs) and incentive (ISOs). With both NQSOs and ISOs, if the stock appreciates beyond your exercise price, you can buy shares […]

3 midyear tax planning strategies for individuals

In the quest to reduce your tax bill, year end planning can only go so far. Tax-saving strategies take time to implement, so review your options now. Here are three strategies that can be more effective if you begin executing them midyear: 1. Consider your bracket The top income tax rate is 39.6% for taxpayers […]