Conflict minerals: SEC reconsiders the disclosure requirements

The Securities and Exchange Commission (SEC) is reviewing its controversial disclosure rule that requires businesses to trace the sources of certain minerals used in their products. Businesses subject to the rule complain about its costs, but human rights groups say it has produced tangible benefits and that the compliance costs are vastly overstated. Will […]

Do you know the tax implications of your C corp.’s buy-sell agreement?

Private companies with more than one owner should have a buy-sell agreement to spell out how ownership shares will change hands should an owner depart. For businesses structured as C corporations, the agreements also have significant tax implications that are important to understand. Buy-sell basics A buy-sell agreement sets up parameters for the transfer […]

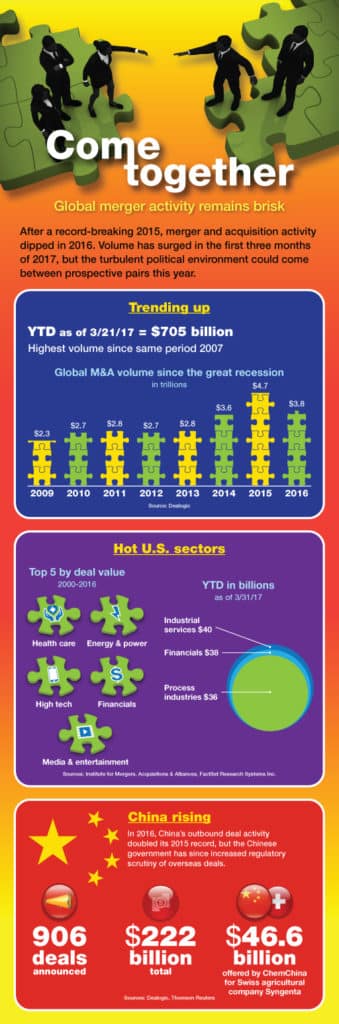

Come together

Now’s a great time to purge old tax records

Whether you filed your 2016 tax return by the April 18 deadline or you filed for an extension, you may be overwhelmed by the amount of documentation involved. While you need to hold on to all of your 2016 tax records for now, it’s a great time to take a look at your records […]

Life insurance and an estate plan may not always mix well

A life insurance policy can be an important part of an estate plan. The tax benefits are twofold: The policy can provide a source of wealth for your family income-tax-free, and it can supply funds to pay estate taxes and other expenses. However, if you own your policy, rather than having, for example, an irrevocable […]

How can you take customer service to the next level?

Just about every business intends to provide world-class customer service. And though many claim their customer service is exceptional, very few can back up that assertion. After all, once a company has established a baseline level of success in interacting with customers, it’s not easy to get to that next level of truly great […]

Measuring “fair value” for financial reporting purposes

The balance sheet usually reflects the historic cost of assets and liabilities. But certain items must be reported at “fair value” under U.S. Generally Accepted Accounting Principles (GAAP). Here’s a closer look at what fair value is and which balance sheet accounts it affects. Fair value vs. fair market value Accounting Standards Codification (ASC) […]

Eagles and jaguars and gold – oh my!

What are the most tax-advantaged ways to reimburse employees’ education expenses?

Reimbursing employees for education expenses can both strengthen the capabilities of your staff and help you retain them. In addition, you and your employees may be able to save valuable tax dollars. But you have to follow IRS rules. Here are a couple of options for maximizing tax savings. A fringe benefit Qualifying reimbursements […]

Bartering may be cash-free, but it’s not tax-free

Bartering might seem like something that happened only in ancient times, but the practice is still common today. And the general definition remains the same: the exchange of goods and services without the exchange of money. Because no cash changes hands in a typical barter transaction, it’s easy to forget about taxes. But, as […]