A “back door” Roth IRA can benefit higher-income taxpayers

A potential downside of tax-deferred saving through a traditional retirement plan is that you’ll have to pay taxes when you make withdrawals at retirement. Roth plans, on the other hand, allow tax-free distributions; the tradeoff is that contributions to these plans don’t reduce your current-year taxable income. Unfortunately, your employer might not offer a […]

Real estate investor vs. professional: Why it matters

Income and losses from investment real estate or rental property are passive by definition — unless you’re a real estate professional. Why does this matter? Passive income may be subject to the 3.8% net investment income tax (NIIT), and passive losses generally are deductible only against passive income, with the excess being carried forward. Of […]

A family bank professionalizes intrafamily lending

If you’re interested in lending money to your children or other family members, consider establishing a “family bank.” These entities enhance the benefits of intrafamily loans, while minimizing unintended consequences. Upsides and downsides of intrafamily lending Lending can be an effective way to provide your family financial assistance without triggering unwanted gift taxes. So long […]

Are your retirement savings secure from creditors?

A primary goal of estate planning is asset protection. After all, no matter how well your estate plan is designed, it won’t do much good if you wind up with no wealth to share with your family. If you have significant assets in employer-sponsored retirement plans or IRAs, it’s important to understand the extent to […]

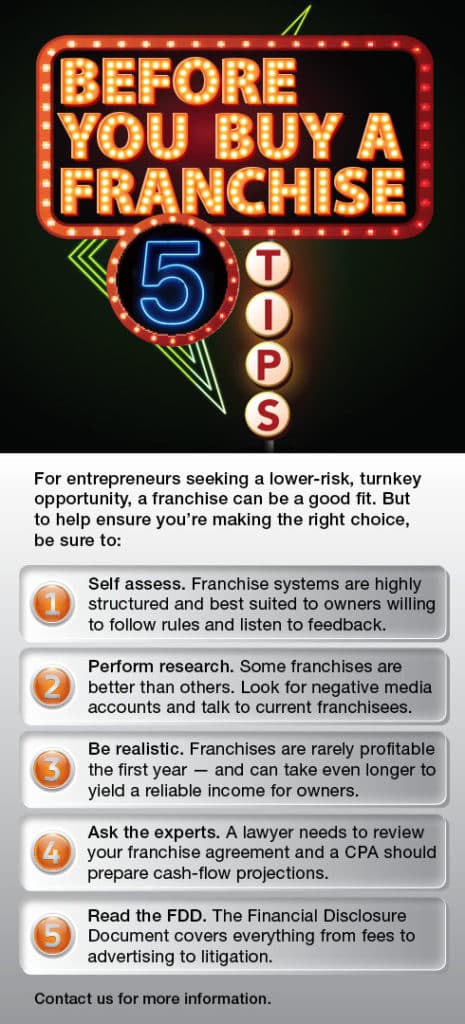

Before You Buy a Franchise

Videotaping your will signing may not produce the desired outcome

Some people make video recordings of their will signings in an effort to create evidence that they possess the requisite testamentary capacity. For some, this strategy may help stave off a will contest. But in most cases, the risk that the recording will provide ammunition to someone who wishes to challenge the will outweighs the […]

It’s a matter of principle — and trust — when using a principle trust

For many, an important estate planning goal is to encourage their children or other heirs to lead responsible, productive lives. One tool for achieving this goal is a principle trust. By providing your trustee with guiding values and principles (rather than the set of rigid rules found in an incentive trust), a principle trust may […]

Business owners: Put your successor in a position to succeed

When it comes time to transition your role as business owner to someone else, you’ll face many changes. One of them is becoming a mentor. As such, you’ll have to communicate clearly, show some patience and have a clear conception of what you want to accomplish before stepping down. Here are some tips on […]

Happy 100th birthday, chartiable deduction!

4 digital marketing tips for every business

You’d be hard pressed to find a company not looking to generate more leads, boost sales and improve its profit margins. Fortunately, you can take advantage of the sales and marketing opportunities offered by today’s digital technologies to do so. Here are four digital marketing tips for every business: 1. Add quality content to […]