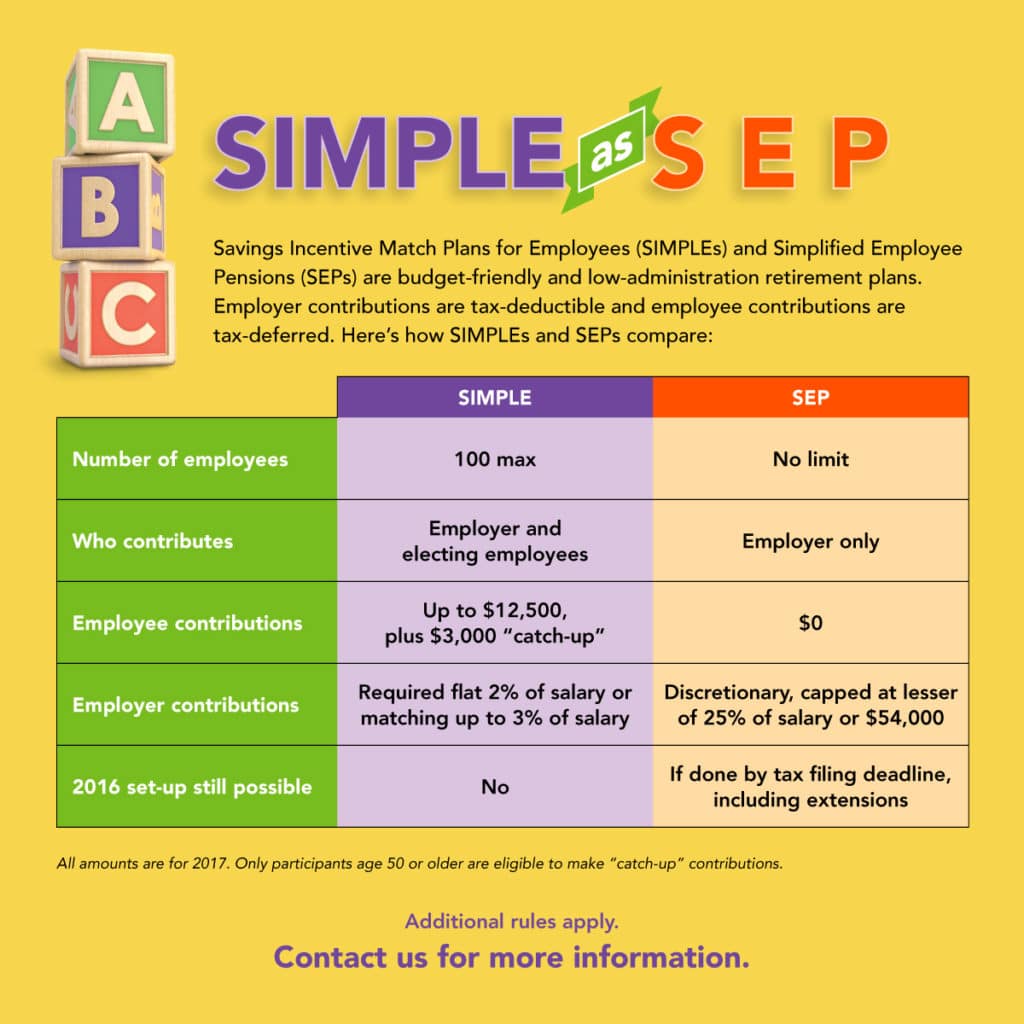

SIMPLE vs SEP

When it comes to charitable deductions, all donations aren’t created equal

As you file your 2016 return and plan your charitable giving for 2017, it’s important to keep in mind the available deduction. It can vary significantly depending on a variety of factors. What you give Other than the actual amount you donate, one of the biggest factors that can affect your deduction is what you […]

Use an ILIT as a wealth preserver

If you’re concerned about your family’s financial well-being after you’re gone, life insurance can provide peace of mind. Going a step further and setting up an irrevocable life insurance trust (ILIT) to hold the policy offers additional estate planning benefits. Asset protection If you’re concerned about your heirs’ money management skills, an ILIT may be […]

Don’t make hunches — crunch the numbers

Some business owners make major decisions by relying on gut instinct. But investments made on a “hunch” often fall short of management’s expectations. In the broadest sense, you’re really trying to answer a simple question: If my company buys a given asset, will the asset’s benefits be greater than its cost? The good news […]

Can the WOTC save tax for your business?

Employers that hire individuals who are members of a “target group” may be eligible for the Work Opportunity tax credit (WOTC). If you made qualifying hires in 2016 and obtained proper certification, you can claim the WOTC on your 2016 tax return. Whether or not you’re eligible for 2016, keep the WOTC in mind […]

Some customers are a real drag

Deduct all of the mileage you’re entitled to — but not more

Rather than keeping track of the actual cost of operating a vehicle, employees and self-employed taxpayers can use a standard mileage rate to compute their deduction related to using a vehicle for business. But you might also be able to deduct miles driven for other purposes, including medical, moving and charitable purposes. What are the […]

Are you leaving your IRA to someone other than your spouse?

An IRA can be a powerful wealth-building tool, offering tax-deferred growth (tax-free in the case of a Roth IRA), asset protection and other benefits. But if you leave an IRA to your children — or to someone else other than your spouse — these benefits can be lost without careful planning. “Inherited IRA” stretches tax […]

What can a valuation expert do for your succession plan?

Most business owners spend a lifetime building their business. And when it comes to succession, they face the difficult decision of whether to sell, dissolve or transfer the business to family members (or a nonfamily successor). Many complicated issues are involved, including how to divvy up business interests, allocate value and tackle complex tax […]

IFRS vs. GAAP: Some public companies want a choice

U.S. public companies are required to report their financial results using U.S. Generally Accepted Accounting Principles (GAAP). But, since 2007, hundreds of foreign companies listed on U.S. stock markets have been able to report financial results using International Financial Reporting Standards (IFRS) instead of GAAP. The Securities and Exchange Commission (SEC) is currently considering […]