Create a strong system of checks and balances

The Securities and Exchange Commission (SEC) requires public companies to evaluate and report on internal controls over financial reporting using a recognized control framework. Private companies generally aren’t required to use a framework for the oversight of internal controls, unless they’re audited, but a strong system of checks and balances is essential for them […]

2017 Q2 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the second quarter of 2017. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. April […]

A refresher on tax-related ACA provisions affecting businesses

Now that the bill to repeal and replace the Affordable Care Act (ACA) has been withdrawn and it’s uncertain whether there will be any other health care reform legislation this year, it’s a good time to review some of the tax-related ACA provisions affecting businesses: Small employer tax credit. Qualifying small employers can claim […]

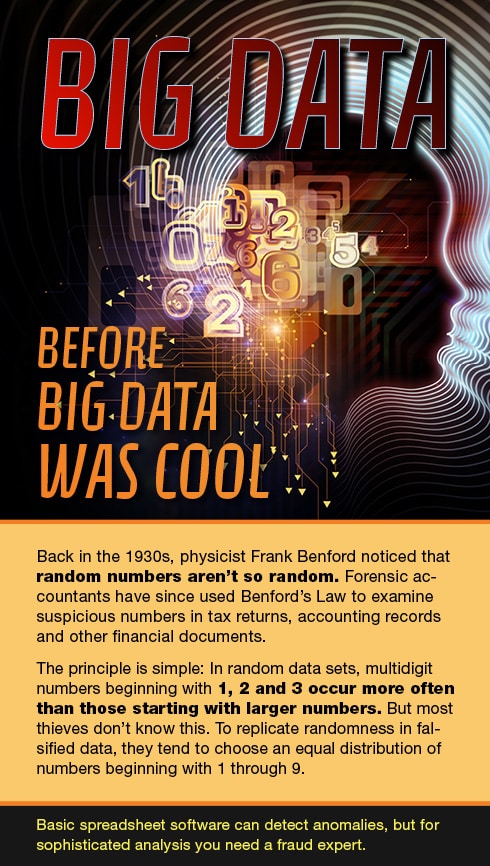

BIG DATA

Victims of a disaster, fire or theft may be able to claim a casualty loss deduction

If you suffered damage to your home or personal property last year, you may be able to deduct these “casualty” losses on your 2016 federal income tax return. A casualty is a sudden, unexpected or unusual event, such as a natural disaster (hurricane, tornado, flood, earthquake, etc.), fire, accident, theft or vandalism. A casualty loss […]

Will your favorite charity accept your donation?

If your estate plan includes charitable donations, be sure to discuss any planned gifts with the intended recipients before you finalize your plan. This is particularly important for donations that place restrictions on the charity’s use of the gift, as well as donations of real estate or other illiquid assets. Why a charity may reject […]

Consider key person insurance as a succession plan safeguard

In business, and in life, among the most important ways to manage risk is through insurance. For certain types of companies — particularly start-ups and small businesses — one major threat is the sudden loss of an owner or hard-to-replace employee. To safeguard against this risk, insurers offer key person insurance. Under a key […]

3 financial statements you should know

Successful business people have a solid understanding of the three financial statements prepared under U.S. Generally Accepted Accounting Principles (GAAP). A complete set of financial statements helps stakeholders — including managers, investors and lenders — evaluate a company’s financial condition and results. Here’s an overview of each report. 1. Income statement The income statement […]

How auditors evaluate fraud risks

Assessing fraud risks is an integral part of the auditing process. Statement on Auditing Standards (SAS) No. 99, Consideration of Fraud in a Financial Statement Audit, requires auditors to consider potential fraud risks before and during the information-gathering process. Business owners and managers may find it helpful to understand how this process works — […]

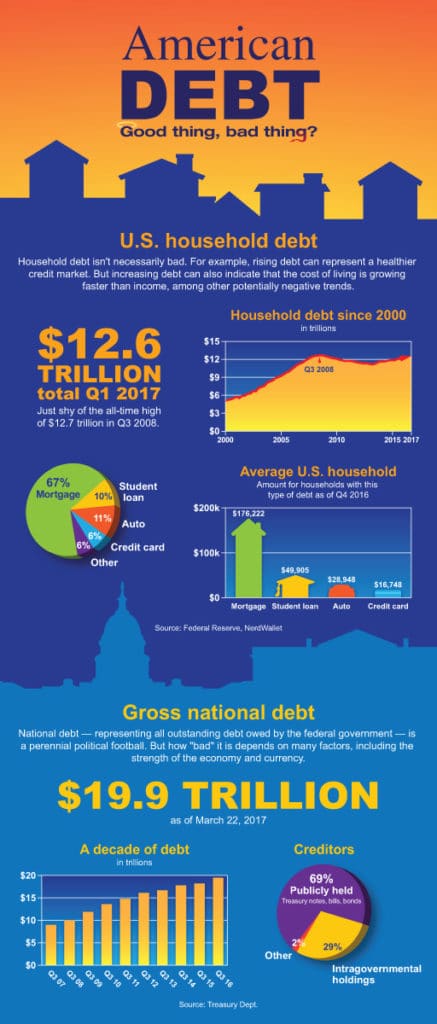

American Debt