Installment sales offer both tax pluses and tax minuses

Whether you’re selling your business or acquiring another company, the tax consequences can have a major impact on the transaction’s success or failure. Consider installment sales, for example. The sale of a business might be structured as an installment sale if the buyer lacks sufficient cash or pays a contingent amount based on the […]

Are you coordinating your income tax planning with your estate plan?

Until recently, estate planning strategies typically focused on minimizing federal gift and estate taxes, such as by giving away assets during life to reduce the taxable estate. Today, however, the focus has moved toward income taxes, making the coordination of income tax planning and estate planning more important. Why the change? Since 2001, the […]

Are you timing business income and expenses to your tax advantage?

Typically, it’s better to defer tax. One way is through controlling when your business recognizes income and incurs deductible expenses. Here are two timing strategies that can help businesses do this: Defer income to next year. If your business uses the cash method of accounting, you can defer billing for your products or services. […]

A quick look at the President-elect’s tax plan for businesses

The election of Donald Trump as President of the United States could result in major tax law changes in 2017. Proposed changes spelled out in Trump’s tax reform plan released earlier this year that would affect businesses include: • Reducing the top corporate income tax rate from 35% to 15%, • Abolishing the corporate […]

How’d you like a $500,000 deduction – expedited?

The wrong life insurance beneficiary can wreak havoc with your estate plan

Life insurance can be a powerful financial and estate planning tool, but its benefits may be reduced or even eliminated if you designate the wrong beneficiary or fail to change beneficiaries when your circumstances change. Here are common pitfalls to avoid: Naming your estate as beneficiary. Doing so subjects life insurance proceeds to unnecessary […]

3 ways to get started on next year’s budget

As the year winds down, business owners have a lot to think about. One item that you should keep top of mind is next year’s budget. A well-conceived budget can go a long way toward keeping expenses in line and cash flow strong. The question is: Where to begin? Well, to answer this question, […]

It’s time to “harvest” investment losses

If you hold investments outside of tax-advantaged retirement plans, you may be able to take steps before year end to reduce your 2016 tax liability. Offsetting gains with losses Suppose you’ve sold investments at a loss this year but you have other investments in your portfolio that have appreciated. If you believe those appreciated […]

Tips for efficient year-end physical inventory counts

Do you dread the year-end physical inventory count? Business owners and managers often view these procedures as time consuming and disruptive. But a well-executed inventory count is more than a matter of compliance. It can also provide valuable insight into improving operational efficiency. Here’s how to run your count to maximize the benefits and […]

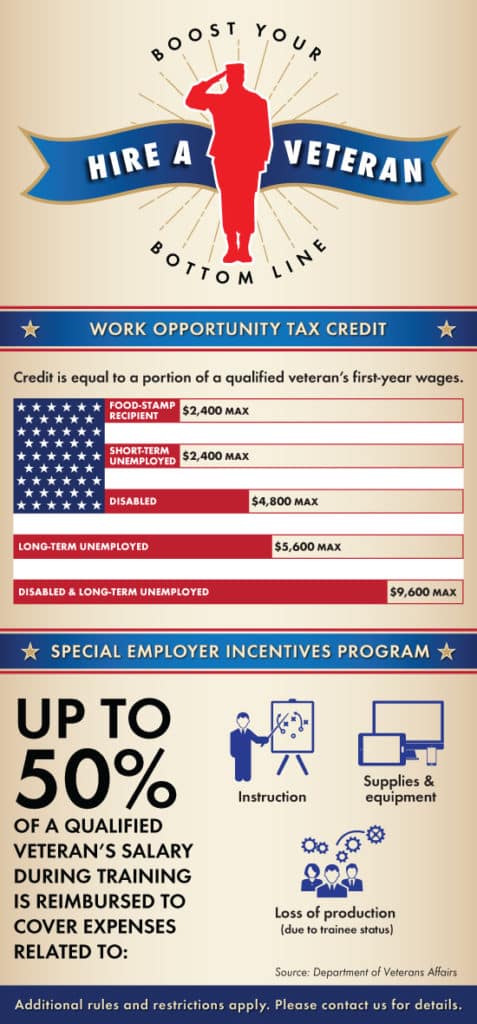

Hire A Veteran