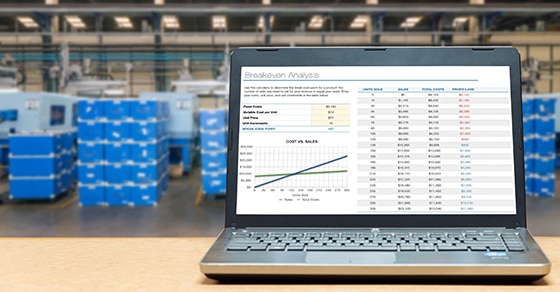

Fixed vs. variable costs: How to compute breakeven

Breakeven analysis can be useful when investing in new equipment, launching a new product or analyzing the effects of a cost reduction plan. The breakeven point is fairly easy to calculate using information from your company’s income statement. Here are the details. Analyzing your costs Breakeven can be explained in a few different ways. […]

Auditing work in progress

Financial statement auditors spend a lot of time evaluating how their clients report work in progress (WIP) inventory. Here’s why this account warrants special attention and how auditors evaluate whether WIP estimates seem reasonable. Accounting for inventory Companies must report the value of raw materials, WIP and finished goods on their balance sheets. WIP […]

Unlock hidden cash from your balance sheet

Need cash in a hurry? Here’s how business owners can look to their financial statements to improve cash flow. Receivables Many businesses turn first to their receivables when trying to drum up extra cash. For example, you could take a carrot-and-stick approach to your accounts receivable — offering early bird discounts to new or […]

Footnote disclosures are critical to transparent financial reporting

Business owners often complain that they’re required to provide too many disclosures under U.S. Generally Accepted Accounting Principles (GAAP). But comprehensive financial statement footnotes contain a wealth of valuable information. Here are some examples of hidden risk factors that may be discovered by reading footnote disclosures. This information is good to know when evaluating […]

How financial statements can be used to value private businesses

Owners of private businesses often wonder: How much is my business interest worth? Financial statements are a logical starting point for answering this question. Here’s an overview of how financial statements can serve as the basis for value under the cost, income and market approaches. Cost approach Because the balance sheet identifies a company’s […]

Income statement items warrant your auditor’s attention

Today’s auditors spend significant time determining whether amounts claimed on the income statement capture the company’s financial performance during the reporting period. Here are some income statement categories that auditors focus on. Revenue Revenue recognition can be complex. Under current accounting rules, companies follow a patchwork of industry-specific guidance. So, companies in different industries may […]

Got multiple locations? Expect auditors to keep a close eye on inventory

Do you remember the high-profile fraud that happened at drugstore chain Phar-Mor in the 1990s? Executives manipulated the company’s financial statements to hide approximately $500 million in losses. A key ploy that perpetrators used in the Phar-Mor case was to overstate inventory balances at individual stores. Management became adept at hiding the scam from their […]

How to conduct a year-end risk assessment

Auditors assess their clients’ risk factors when planning for next year’s financial statement audit. Likewise, proactive managers assess risks at year end. A so-called “SWOT” analysis can help frame that assessment. Typically presented as a matrix, this analysis of strengths, weaknesses, opportunities and threats provides a logical framework for understanding how a business runs. It […]

5 common sources of substantive audit evidence

Do you understand how auditors verify account balances and transactions? This knowledge can minimize disruptions when the audit team visits your facilities and maximize the effectiveness of your audit. Here’s a list of five common sources of “substantive evidence” that auditors gather to help them form an opinion regarding your financial statements. 1. Confirmation […]

Consider how tax reform would affect your financial statements

Tax reform legislation might be enacted before year end. If it is, companies following U.S. Generally Accepted Accounting Principles (GAAP) will have to recognize the effects of the changes in 2017 — not when the changes go into effect in 2018 and beyond. Here’s what calendar-year businesses need to know as they report their […]