Don’t ignore the Oct. 16 extended filing deadline just because you can’t pay your tax bill

The extended deadline for filing 2016 individual federal income tax returns is October 16. If you extended your return and know you owe tax but can’t pay the bill, you may be wondering what to do next. File by October 16 First and foremost, file your return by October 16. Filing by the extended deadline […]

Investors: Beware of the wash sale rule

A tried-and-true tax-saving strategy for investors is to sell assets at a loss to offset gains that have been realized during the year. So if you’ve cashed in some big gains this year, consider looking for unrealized losses in your portfolio and selling those investments before year end to offset your gains. This can […]

Why you should boost your 401(k) contribution rate between now and year end

One important step to both reducing taxes and saving for retirement is to contribute to a tax-advantaged retirement plan. If your employer offers a 401(k) plan, contributing to that is likely your best first step. If you’re not already contributing the maximum allowed, consider increasing your contribution rate between now and year end. Because of […]

Save more for college through the tax advantages of a 529 savings plan

With kids back in school, it’s a good time for parents (and grandparents) to think about college funding. One option, which can be especially beneficial if the children in question still have many years until they’ll be starting their higher education, is a Section 529 plan. Tax-deferred compounding 529 plans are generally state-sponsored, and the […]

Watch out for potential tax pitfalls of donating real estate to charity

Charitable giving allows you to help an organization you care about and, in most cases, enjoy a valuable income tax deduction. If you’re considering a large gift, a noncash donation such as appreciated real estate can provide additional benefits. For example, if you’ve held the property for more than one year, you generally will be […]

The ABCs of the tax deduction for educator expenses

At back-to-school time, much of the focus is on the students returning to the classroom — and on their parents buying them school supplies, backpacks, clothes, etc., for the new school year. But let’s not forget about the teachers. It’s common for teachers to pay for some classroom supplies out of pocket, and the tax […]

Material participation key to deducting LLC and LLP losses

If your business is a limited liability company (LLC) or a limited liability partnership (LLP), you know that these structures offer liability protection and flexibility as well as tax advantages. But they once also had a significant tax disadvantage: The IRS used to treat all LLC and LLP owners as limited partners for purposes […]

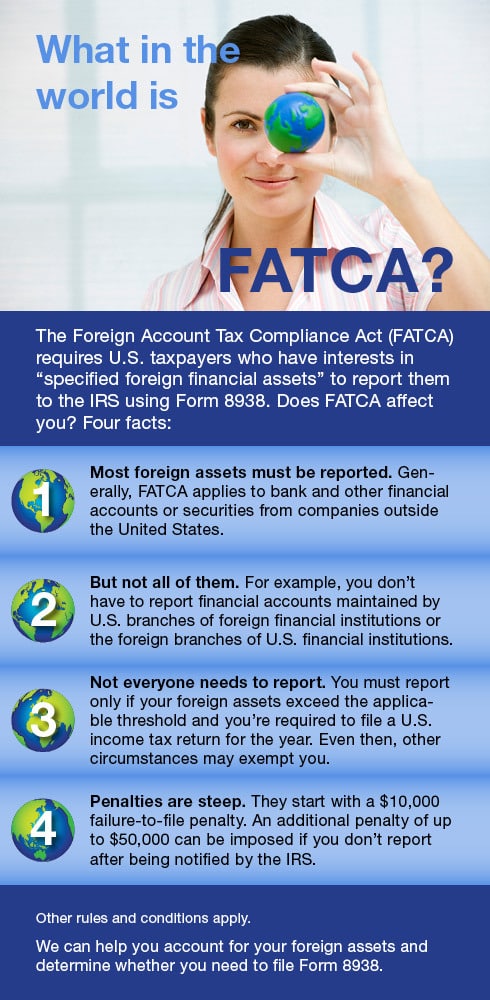

What in the world is FATCA?

Own a vacation home? Adjusting rental vs. personal use might save taxes

Now that we’ve hit midsummer, if you own a vacation home that you both rent out and use personally, it’s a good time to review the potential tax consequences: If you rent it out for less than 15 days: You don’t have to report the income. But expenses associated with the rental (such as advertising […]

Nonqualified stock options demand tax planning attention

Your compensation may take several forms, including salary, fringe benefits and bonuses. If you work for a corporation, you might also receive stock-based compensation, such as stock options. These come in two varieties: nonqualified (NQSOs) and incentive (ISOs). With both NQSOs and ISOs, if the stock appreciates beyond your exercise price, you can buy shares […]