Consider key person insurance as a succession plan safeguard

In business, and in life, among the most important ways to manage risk is through insurance. For certain types of companies — particularly start-ups and small businesses — one major threat is the sudden loss of an owner or hard-to-replace employee. To safeguard against this risk, insurers offer key person insurance. Under a key […]

3 financial statements you should know

Successful business people have a solid understanding of the three financial statements prepared under U.S. Generally Accepted Accounting Principles (GAAP). A complete set of financial statements helps stakeholders — including managers, investors and lenders — evaluate a company’s financial condition and results. Here’s an overview of each report. 1. Income statement The income statement […]

How auditors evaluate fraud risks

Assessing fraud risks is an integral part of the auditing process. Statement on Auditing Standards (SAS) No. 99, Consideration of Fraud in a Financial Statement Audit, requires auditors to consider potential fraud risks before and during the information-gathering process. Business owners and managers may find it helpful to understand how this process works — […]

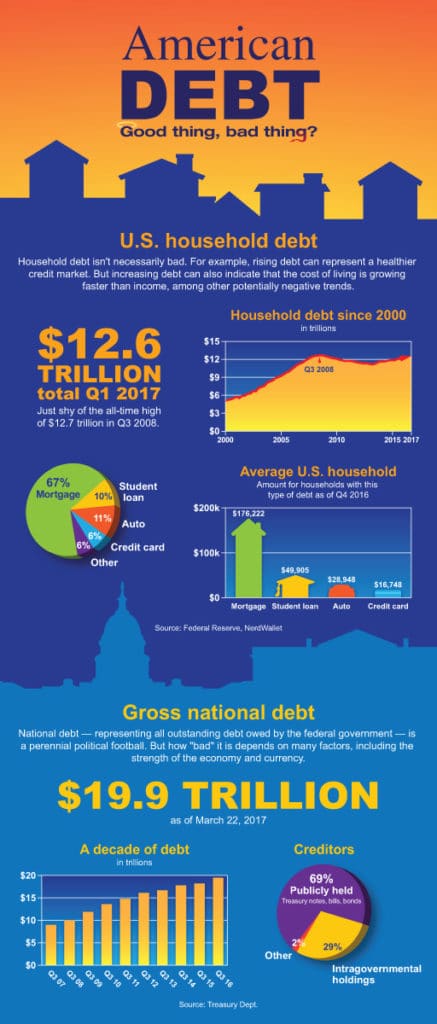

American Debt

Make sure the IRS won’t consider your business to be a “hobby”

If you run a business “on the side” and derive most of your income from another source (whether from another business you own, employment or investments), you may face a peculiar risk: Under certain circumstances, this on-the-side business might not be a business at all in the eyes of the IRS. It may be […]

Who can — and who should — take the American Opportunity credit?

If you have a child in college, you may be eligible to claim the American Opportunity credit on your 2016 income tax return. If, however, your income is too high, you won’t qualify for the credit — but your child might. There’s one potential downside: If your dependent child claims the credit, you must […]

Offer plan loans? Be sure to set a reasonable interest rate

Like many businesses, yours may allow retirement plan participants to take out loans from their accounts. Such loans are governed by many IRS and Department of Labor (DOL) rules and regulations. So if your company offers plan loans, your plan document must comply with current laws — including setting a “reasonable” interest rate. Agency […]

Direct tuition payments benefit your grandchild and your estate plan

Grandparents often want to play a role in financing their grandchildren’s education. If you’re one of them, it’s important to consider the impact that different financing options will have on your estate plan. Make direct tuition payments A simple but effective technique is to make tuition payments on behalf of your grandchild. So long as […]

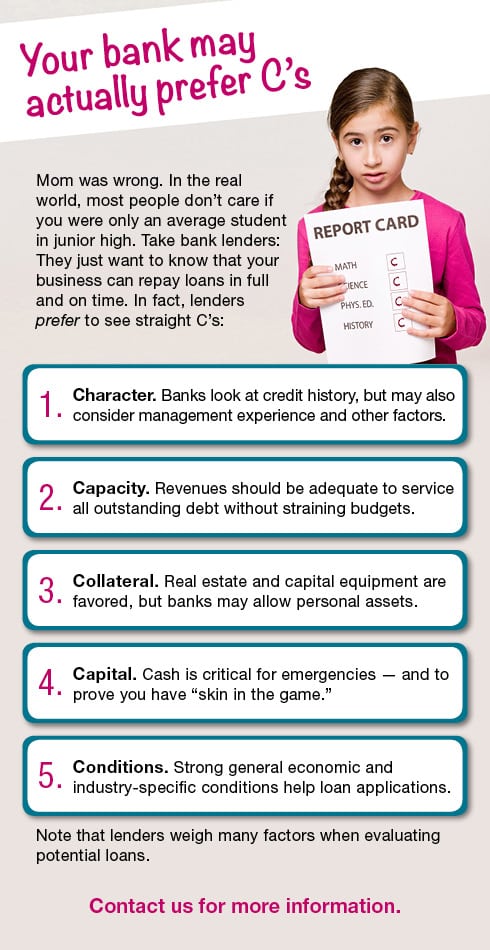

Your bank may actually prefer C’s

Save the Date!