Your company’s balance sheet makes great reading this time of year

Year end is just about here. You know what that means, right? It’s a great time to settle in by a roaring fire and catch up on reading … your company’s financial statements. One chapter worth a careful perusal is the balance sheet. Therein may lie some important lessons. 3 ratios to consider In […]

How to report discontinued operations today

Did your company undergo a major strategic shift in 2016? If so, management may need to comply with the updated rules for reporting discontinued operations that went into effect in 2015 for most companies. Discontinued operations typically don’t happen every year, so it’s important to review the basics before preparing your year-end financial statements. […]

Can you pay bonuses in 2017 but deduct them this year?

You may be aware of the rule that allows businesses to deduct bonuses employees have earned during a tax year if the bonuses are paid within 2½ months after the end of that year (by March 15 for a calendar-year company). But this favorable tax treatment isn’t always available. For one thing, only accrual-basis […]

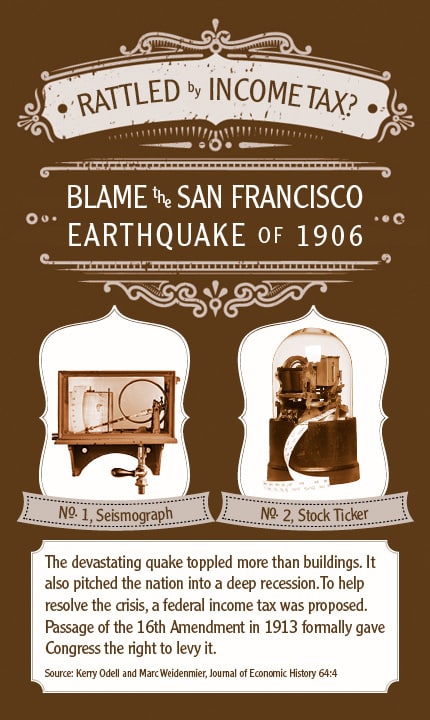

Rattled by Income Tax?

Workers age 50 and up: Boost retirement savings before year end with catch-up contributions

Whether you didn’t save as much for retirement as you would have wished earlier in your career or you’d simply like to make the most of tax-advantaged savings opportunities, if you’ll be age 50 or older on December 31, consider making “catch-up” contributions to your employer-sponsored retirement plan by that date. These are additional contributions […]

Relocating into or out of a community property state requires extra estate planning

When a married couple lives in a community property state, the money earned and property acquired by either spouse during their marriage generally belongs to the “community.” This means that each spouse has an undivided one-half interest in the property (regardless of how property is titled). Then, when one spouse dies, his or her […]

Family matters: Stepchildren and your estate plan

If you have unadopted stepchildren, estate planning is critical to ensure that your property is distributed the way you desire. Stepchildren generally don’t have any inheritance rights with respect to their parents’ new spouses unless the spouse legally adopts them. If you have stepchildren and want them to share in your estate, one option […]

Keeping your family business in the family

A successful family business can provide long-term financial security for you as its owner, as well as for your loved ones. To improve the chances that your company will continue to benefit your heirs after you’re gone, take steps now to keep it in the family. Staying in-house Careful estate planning can ensure that […]

Reporting UTPs

Navigating the tax code — and staying atop the latest tax law developments — can be challenging for business owners. In turn, financial reporting for uncertain tax positions (UTPs), such as pending IRS audits or lawsuits, is complicated and subjective. Here’s some guidance to help clarify matters. Applying the threshold Companies that follow U.S. […]

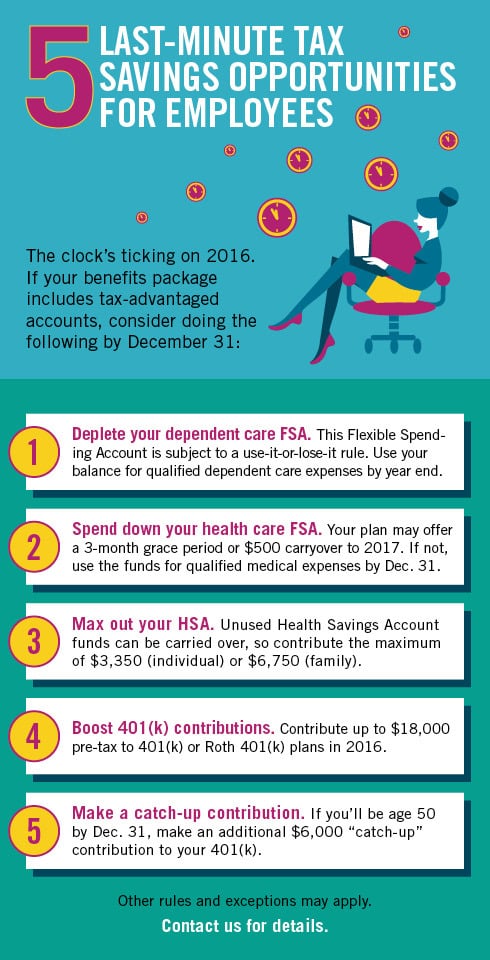

5 Last-minute tax savings opportunities