Close-up on the new QBI deduction’s wage limit

The Tax Cuts and Jobs Act (TCJA) provides a valuable new tax break to noncorporate owners of pass-through entities: a deduction for a portion of qualified business income (QBI). The deduction generally applies to income from sole proprietorships, partnerships, S corporations and, typically, limited liability companies (LLCs). It can equal as much as 20% of […]

3 traditional midyear tax planning strategies for individuals that hold up post-TCJA

With its many changes to individual tax rates, brackets and breaks, the Tax Cuts and Jobs Act (TCJA) means taxpayers need to revisit their tax planning strategies. Certain strategies that were once tried-and-true will no longer save or defer tax. But there are some that will hold up for many taxpayers. And they’ll be more […]

Double duty giving with charitable gift annuities

If you’re charitably inclined, you may wish to consider a charitable gift annuity. It can combine the benefits of an immediate income tax deduction and a lifetime income stream. Furthermore, it allows you to support a favorite charity and reduce the size of your future taxable estate. What is it? A charitable gift annuity is […]

Trust is an essential building block of today’s websites

When business use of websites began, getting noticed was the name of the game. Remember pop-up ads? Text scrolling up the screen? How about those mesmerizing rotating banners? Yes, there were — and remain — a variety of comical and some would say annoying ways to get visitors’ attention. Nowadays, most Internet users are savvy […]

Transitioning to remote audits

Are you comfortable communicating electronically with your auditors? If so, a logical next step might be to transition from on-site audit procedures to a more “remote” approach. Remote audits can help reduce the time and cost of preparing audited financial statements. 21st century audits Traditionally, audit fieldwork has involved a team of auditors camping out […]

21st century estate planning accounts for digital assets

Even though you can’t physically touch digital assets, they’re just as important to include in your estate plan as your material assets. Digital assets may include online bank and brokerage accounts, digital photo galleries, and even email and social media accounts. If you die without addressing these assets in your estate plan, your loved ones […]

3 keys to a successful accounting system upgrade

Technology is tricky. Much of today’s software is engineered so well that it will perform adequately for years. But new and better features are being created all the time. And if you’re not getting as much out of your financial data as your competitors are, you could be at a disadvantage. For these reasons, it […]

Consider these financial reporting issues before going private

Issuing stock on the public markets isn’t right for every business. Some public companies decide to delist — or “go private” — often due to the high costs of complying with the requirements of the Securities and Exchange Commission (SEC). But going private can be nearly as complex as going public, so it’s important to […]

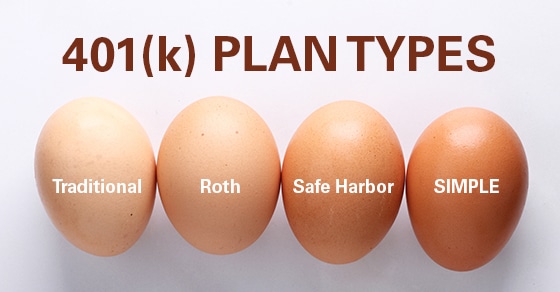

Finding a 401(k) that’s right for your business

By and large, today’s employees expect employers to offer a tax-advantaged retirement plan. A 401(k) is an obvious choice to consider, but you may not be aware that there are a variety of types to choose from. Let’s check out some of the most popular options: Traditional. Employees contribute on a pretax basis, with the […]

Is it time to adopt the new hedge accounting principles?

Implementing changes in accounting rules can be a real drag. But the new hedge accounting standard may be an exception to this generality. Many companies welcome this update and may even want to adopt it early, because the new rules are more flexible and attempt to make hedging strategies easier to report on financial statements. […]