Do your employees receive tips? You may be eligible for a tax credit

Are you an employer who owns a business where tipping is customary for providing food and beverages? You may qualify for a tax credit involving the Social Security and Medicare (FICA) taxes that you pay on your employees’ tip income. How the credit works The FICA credit applies with respect to tips that your employees […]

Numerous tax limits affecting businesses have increased for 2020

An array of tax-related limits that affect businesses are annually indexed for inflation, and many have increased for 2020. Here are some that may be important to you and your business. Social Security tax The amount of employees’ earnings that are subject to Social Security tax is capped for 2020 at $137,700 (up from $132,900 […]

Cents-per-mile rate for business miles decreases slightly for 2020

This year, the optional standard mileage rate used to calculate the deductible costs of operating an automobile for business decreased by one-half cent, to 57.5 cents per mile. As a result, you might claim a lower deduction for vehicle-related expense for 2020 than you can for 2019. Calculating your deduction Businesses can generally deduct the […]

New law provides a variety of tax breaks to businesses and employers

While you were celebrating the holidays, you may not have noticed that Congress passed a law with a grab bag of provisions that provide tax relief to businesses and employers. The “Further Consolidated Appropriations Act, 2020” was signed into law on December 20, 2019. It makes many changes to the tax code, including an extension […]

Your home office expenses may be tax deductible

Technology has made it easier to work from home so lots of people now commute each morning to an office down the hall. However, just because you have a home office space doesn’t mean you can deduct expenses associated with it. Regularly and exclusively In order to be deductible for 2019 and 2020, you must […]

Small Businesses: It may not be not too late to cut your 2019 taxes

Don’t let the holiday rush keep you from taking some important steps to reduce your 2019 tax liability. You still have time to execute a few strategies, including: 1. Buying assets.Thinking about purchasing new or used heavy vehicles, heavy equipment, machinery or office equipment in the new year? Buy it and place it in service […]

2020 Q1 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2020. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. January […]

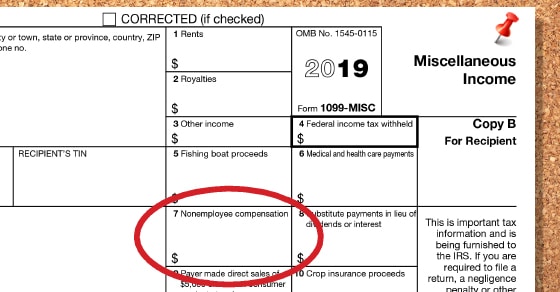

Small businesses: Get ready for your 1099-MISC reporting requirements

A month after the new year begins, your business may be required to comply with rules to report amounts paid to independent contractors, vendors and others. You may have to send 1099-MISC forms to those whom you pay nonemployee compensation, as well as file copies with the IRS. This task can be time consuming and […]

What lenders look for in a succession plan

Business owners are urged to create succession plans for the good of their families and their employees. But there’s someone else who holds a key interest in the longevity of your company: Your lender. If you want to maintain a clear path to acquiring the working capital your business may need after you’ve stepped down, […]

2 valuable year-end tax-saving tools for your business

At this time of year, many business owners ask if there’s anything they can do to save tax for the year. Under current tax law, there are two valuable depreciation-related tax breaks that may help your business reduce its 2019 tax liability. To benefit from these deductions, you must buy eligible machinery, equipment, furniture or […]