Want to turn a hobby into a business? Watch out for the tax rules

Like many people, you may have dreamed of turning a hobby into a regular business. You won’t have any tax headaches if your new business is profitable. But what if the new enterprise consistently generates losses (your deductions exceed income) and you claim them on your tax return? You can generally deduct losses for […]

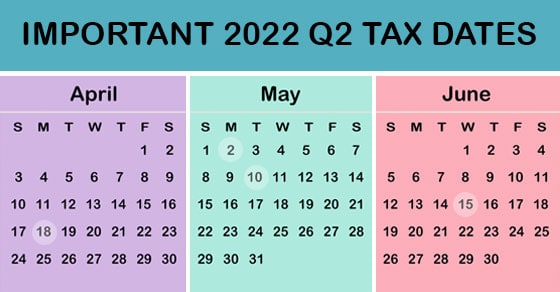

2022 Q2 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines that apply to businesses and other employers during the second quarter of 2022. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the […]

It’s almost that time of year again! If you’re not ready, file for an extension

The clock is ticking down to the April 18 tax filing deadline. Sometimes, it’s not possible to gather your tax information and file by the due date. If you need more time, you should file for an extension on Form 4868. An extension will give you until October 17 to file and allows you […]

Making withdrawals from your closely held corporation that aren’t taxed as dividends

Do you want to withdraw cash from your closely held corporation at a minimum tax cost? The simplest way is to distribute cash as a dividend. However, a dividend distribution isn’t tax-efficient since it’s taxable to you to the extent of your corporation’s “earnings and profits.” It’s also not deductible by the corporation. Five […]

Married couples filing separate tax returns: Why would they do it?

If you’re married, you may wonder whether you should file joint or separate tax returns. The answer depends on your individual tax situation. In general, it depends on which filing status results in the lowest tax. But keep in mind that, if you and your spouse file a joint return, each of you is […]

Did you give to charity in 2021? Make sure you have substantiation

If you donated to charity last year, letters from the charities may have appeared in your mailbox recently acknowledging the donations. But what happens if you haven’t received such a letter — can you still claim a deduction for the gift on your 2021 income tax return? It depends. The requirements To prove a […]

The Ins and Outs of IRAs

Traditional IRAs and Roth IRAs have been around for decades and the rules surrounding them have changed many times. What hasn’t changed is that they can help you save for retirement on a tax-favored basis. Here’s an overview. Traditional IRAs You can make an annual deductible contribution to a traditional IRA if: You (and […]

Keeping meticulous records is the key to tax deductions and painless IRS audits

If you operate a business, or you’re starting a new one, you know you need to keep records of your income and expenses. Specifically, you should carefully record your expenses in order to claim all of the tax deductions to which you’re entitled. And you want to make sure you can defend the amounts […]

Entrepreneurs and taxes: How expenses are claimed on tax returns

While some businesses have closed since the start of the COVID-19 crisis, many new ventures have launched. Entrepreneurs have cited a number of reasons why they decided to start a business in the midst of a pandemic. For example, they had more time, wanted to take advantage of new opportunities or they needed money […]

Smooth sailing: Tips to speed processing and avoid hassles this tax season

The IRS began accepting 2021 individual tax returns on January 24. If you haven’t prepared yet for tax season, here are three quick tips to help speed processing and avoid hassles. Tip 1. Contact us soon for an appointment to prepare your tax return. Tip 2. Gather all documents needed to prepare an accurate […]