Tax season can be a stressful time for many, but with proper planning and expert assistance, it doesn’t have to be. At OnTarget CPA, we provide comprehensive tax preparation services tailored to the unique needs of Indianapolis residents.

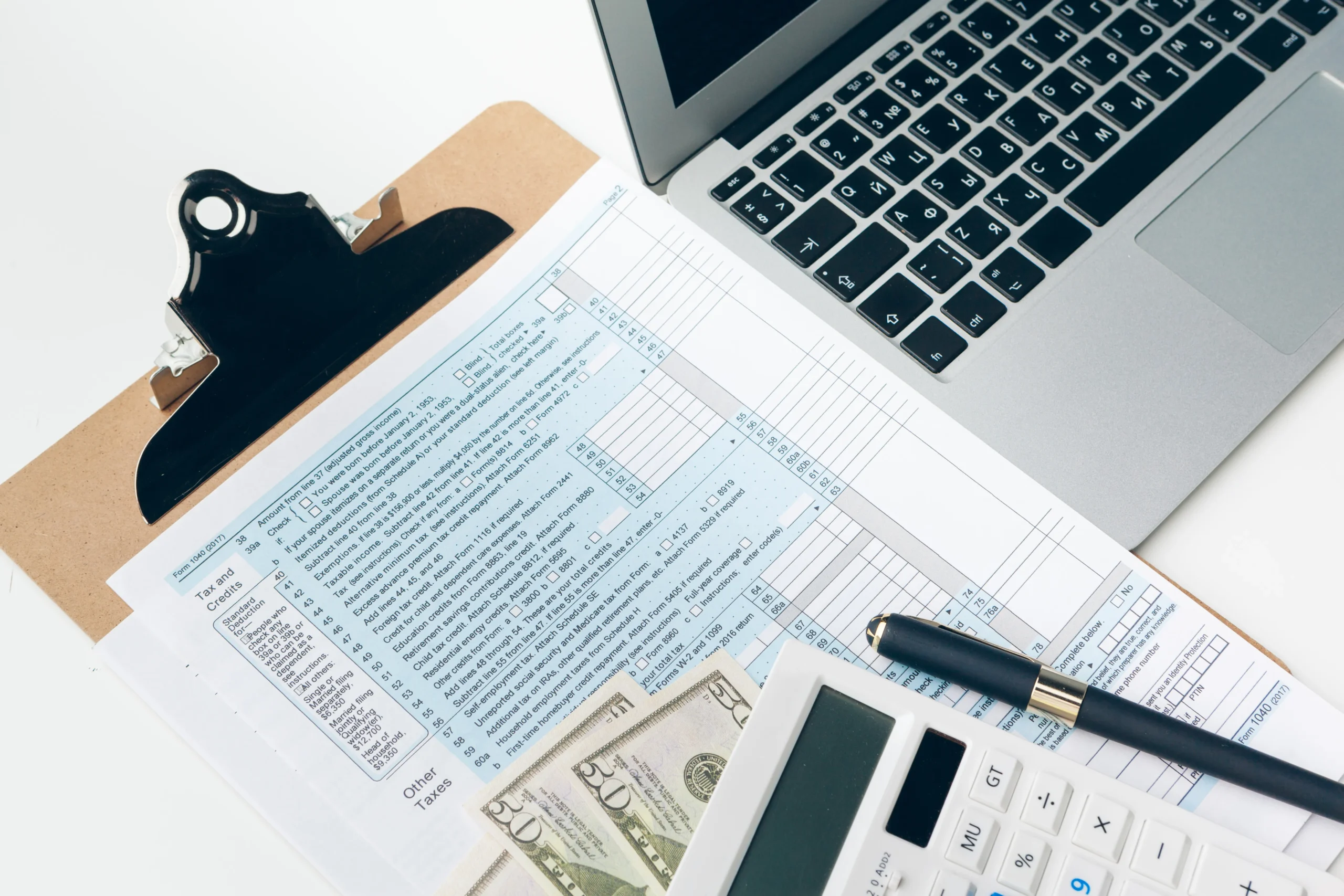

Organize Your Financial Documents

Begin by gathering all necessary documents, including W-2s, 1099s, mortgage interest statements, and records of charitable contributions. Having these documents organized will streamline the preparation process and ensure no deductions are overlooked.

Understand Local Tax Regulations

Indiana has specific tax laws that may affect your return. Our team stays up-to-date with the latest state regulations to ensure compliance and identify potential savings opportunities.

Maximize Deductions and Credits

From education credits to deductions for medical expenses, we help identify all applicable tax benefits to reduce your liability. Our personalized approach ensures you receive the maximum refund possible.

Avoid Common Pitfalls

Errors on tax returns can lead to delays or audits. Our meticulous review process minimizes the risk of mistakes, providing peace of mind that your return is accurate and complete.

Plan for the Future

Beyond filing, we offer strategic tax planning services to prepare you for the year ahead. By analyzing your financial situation, we can recommend strategies to minimize future tax burdens.

Take the Next Step with OnTarget CPA

Don’t navigate tax season alone. Contact OnTarget CPA today to schedule a consultation and experience stress-free tax preparation with our expert team.