Back-to-school marketing ideas for savvy business owners

August is back-to-school time across the country. Whether the school buses are already rumbling down your block, or will be soon, the start of the school year brings marketing opportunities for savvy business owners. Here are some examples of ways companies can promote themselves. A virtual “brag book” A creative agency posts on social […]

Ensuring a peaceful succession with a buy-sell agreement

A buy-sell agreement is a critical component of succession planning for many businesses. It sets the terms and conditions under which an owner’s business interest can be sold to another owner (or owners) should an unexpected tragedy or turn of events occurs. It also establishes the method for determining the price of the interest. […]

Credit loss standard: The new CECL model

A new accounting standard on credit losses goes into effect in 2020 for public companies and 2021 for private ones. It will result in earlier recognition of losses and expand the range of information considered in determining expected credit losses. Here’s how the new methodology differs from existing practice. Existing model Under existing U.S. […]

Close-up on cutoffs for reporting revenues and expenses

Under U.S. Generally Accepted Accounting Principles (GAAP), there are strict rules on when to recognize revenues and expenses. Here’s important information about end of period accounting “cutoffs” as companies start to adopt the new revenue recognition standard. Cutoff games How closely does your company follow the cutoff rules? The end of the period serves […]

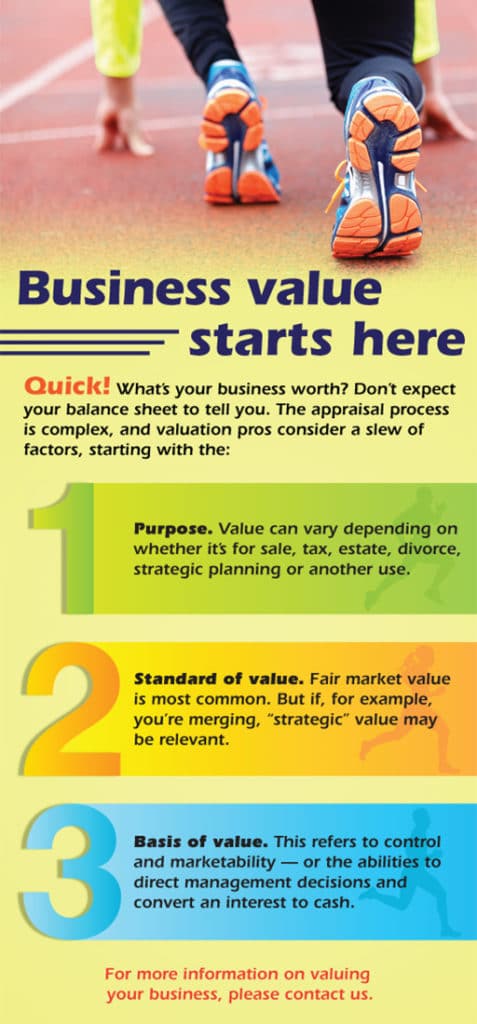

Business Value Starts Here

Dot the “i’s” and cross the “t’s” on loans between your business and its owners

It’s common for closely held businesses to transfer money into and out of the company, often in the form of a loan. However, the IRS looks closely at such transactions: Are they truly loans, or actually compensation, distributions or contributions to equity? Loans to owners When an owner withdraws funds from the company, the […]

3 breaks for business charitable donations you may not know about

Donating to charity is more than good business citizenship; it can also save tax. Here are three lesser-known federal income tax breaks for charitable donations by businesses. 1. Food donations Charitable write-offs for donated food (such as by restaurants and grocery stores) are normally limited to the lower of the taxpayer’s basis in the […]

Keep real estate separate from your business’s corporate assets to save tax

It’s common for a business to own not only typical business assets, such as equipment, inventory and furnishings, but also the building where the business operates — and possibly other real estate as well. There can, however, be negative consequences when a business’s real estate is included in its general corporate assets. By holding […]

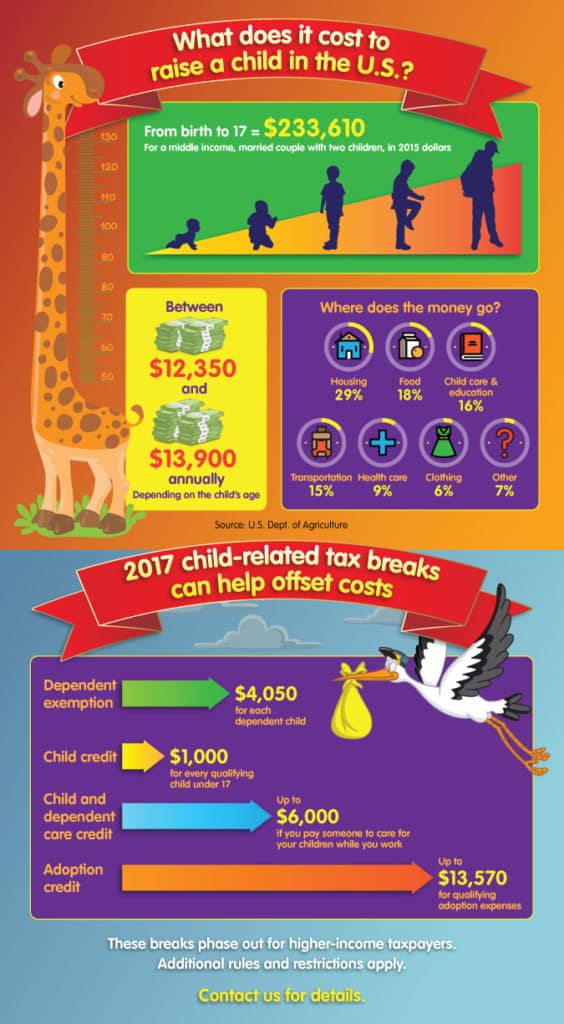

What does it cost to raise a child in the U.S.?

Is now the time for a charitable lead trust?

Families who wish to give to charity while minimizing gift and estate taxes should consider a charitable lead trust (CLT). These trusts are most effective in a low-interest-rate environment, so conditions for taking advantage of a CLT currently are favorable. Although interest rates have crept up in recent years, they remain historically low. 2 types […]