Keep real estate separate from your business’s corporate assets to save tax

It’s common for a business to own not only typical business assets, such as equipment, inventory and furnishings, but also the building where the business operates — and possibly other real estate as well. There can, however, be negative consequences when a business’s real estate is included in its general corporate assets. By holding […]

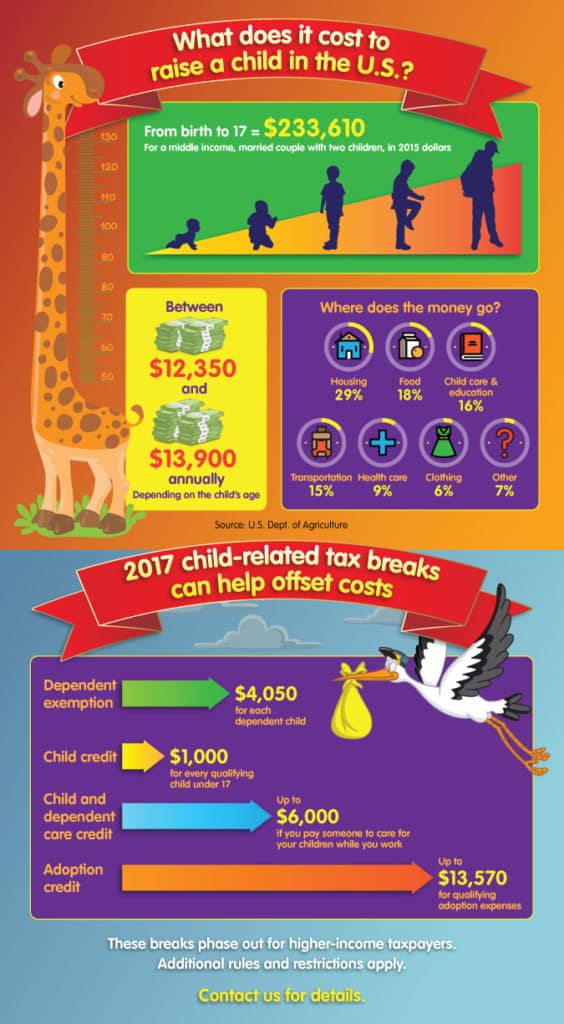

What does it cost to raise a child in the U.S.?

Is now the time for a charitable lead trust?

Families who wish to give to charity while minimizing gift and estate taxes should consider a charitable lead trust (CLT). These trusts are most effective in a low-interest-rate environment, so conditions for taking advantage of a CLT currently are favorable. Although interest rates have crept up in recent years, they remain historically low. 2 types […]

Leaving specific assets to specific heirs is an estate planning no-no

Planning your estate around specific assets is risky and, in most cases, should be avoided. If you leave specific assets — such as a home, a car or stock — to specific people, you could end up inadvertently disinheriting someone. Unintended consequences Here’s an example that illustrates the problem: Kim has three children — Sarah, […]

Are you familiar with fraudulent transfer laws?

A primary goal of your estate plan is to transfer wealth to your family according to your wishes and at the lowest possible tax cost. However, if you have creditors, be aware of fraudulent transfer laws. In a nutshell, if your creditors challenge your gifts, trusts or other strategies as fraudulent transfers, they can quickly […]

Why business owners should regularly upgrade their accounting software

Many business owners buy accounting software and, even if the installation goes well, eventually grow frustrated when they don’t get the return on investment they’d expected. There’s a simple reason for this: Stuff changes. Technological improvements are occurring at a breakneck speed. So yesterday’s cutting-edge system can quickly become today’s sluggishly performing albatross. And […]

You don’t have to take business insurance costs sitting down

Adequate insurance coverage is, in many cases, a legal requirement for a business. Even if it’s not for your company, proper coverage remains a risk management imperative. But that doesn’t mean you have to take high insurance costs sitting down. There are a wide variety of ways you can decrease insurance costs. Just two […]

Seasonal business? Optimize your operating cycle

Every business has some degree of ups and downs during the year. But cash flow fluctuations are much more intense for seasonal businesses. So, if your company defines itself as such, it’s important to optimize your operating cycle to anticipate and minimize shortfalls. A high-growth example To illustrate: Consider a manufacturer and distributor of […]

Respecting auditor independence

Auditor independence is still a hot topic among investors and lenders even though the financial crisis of 2008 was nine years ago. Here’s an overview of the independence guidance from the Securities and Exchange Commission (SEC). These rules apply specifically to public companies, but auditors of private companies are typically held to the same […]

Pay attention to the details when selling investments

The tax consequences of the sale of an investment, as well as your net return, can be affected by a variety of factors. You’re probably focused on factors such as how much you paid for the investment vs. how much you’re selling it for, whether you held the investment long-term (more than one year) and […]