New HRA offers small employers an attractive, tax-advantaged health care option

In December, Congress passed the 21st Century Cures Act. The long and complex bill covers a broad range of health care topics, but of particular interest to some businesses should be the Health Reimbursement Arrangement (HRA) provision. Specifically, qualified small employers can now use HRAs to reimburse employees who purchase individual insurance coverage, rather […]

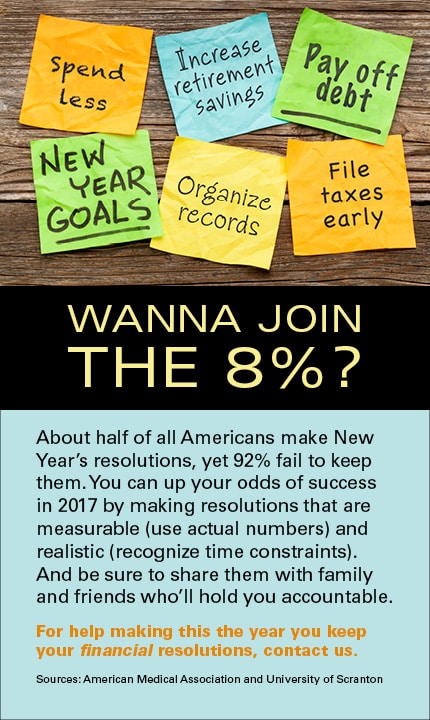

Wanna join the 8%?

What your exit plan?

2017 Q1 tax calendar: Key deadlines for businesses and other employers

Here are some of the key tax-related deadlines affecting businesses and other employers during the first quarter of 2017. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that apply to you. Contact us to ensure you’re meeting all applicable deadlines and to learn more about the filing requirements. […]

4 principles of competitive intelligence

We live and work in the information age. As such, the opportunity to gather knowledge about your company’s competitors and industry as a whole has never been better. This practice — commonly known as “competitive intelligence” — can help you stay more nimble in the marketplace and avoid getting left behind as innovation surges […]

How entity type affects tax planning for owner-employees

Come tax time, owner-employees face a variety of distinctive tax planning challenges, depending on whether their business is structured as a partnership, limited liability company (LLC) or corporation. Whether you’re thinking about your 2016 filing or planning for 2017, it’s important to be aware of the challenges that apply to your particular situation. Partnerships and […]

Take stock of your inventory accounting method’s impact on your tax bill

If your business involves the production, purchase or sale of merchandise, your inventory accounting method can significantly affect your tax liability. In some cases, using the last-in, first-out inventory accounting method, rather than first-in, first-out, can reduce taxable income, giving cash flow a boost. Tax savings, however, aren’t the only factor to consider. Which Method? […]

Few changes to retirement plan contribution limits for 2017

Retirement plan contribution limits are indexed for inflation, but with inflation remaining low, most of the limits remain unchanged for 2017. The only limit that has increased from the 2016 level is for contributions to defined contribution plans, which has gone up by $1,000. Nevertheless, if you’re not already maxing out your contributions, you still […]

Get smart when tackling estate planning for intellectual property

If you own intellectual property (IP), such as a patent or copyright, you need to know how to account for it in your estate plan. These intangible assets can be highly valuable, and you’ll want them to be handled according to your wishes after you die. 2 important questions IP generally falls into one […]

Considering a spinoff? Think it through

In popular culture, the word “spinoff” usually refers to a television show whose main characters originated from an already established show. But the word applies to the business world, too. Here it describes a division or subsidiary of a company being sold off to a buyer as a separate entity. The process is hardly simple. […]