Build consensus before you buy business software

Business owners get to make executive decisions. It’s one of the perks of the job. But acting unilaterally when buying business software can be a risky move. Because new technology affects the entire team, the entire team (or at least key members) should have input on the choice. And while it may be impossible […]

Companies restate financial results for a variety of reasons

When a company reissues or revises its financial statements, some people automatically assume that management is cooking the books. But there can be legitimate reasons for restatements, beyond management incompetence and fraud. So, before leaping to conclusions, it’s important to understand what went wrong — and find ways to prevent future restatements. Complex standards Often, […]

2016 Tax Breaks

Help prevent the year-end vacation-time scramble with a PTO contribution arrangement

Many businesses find themselves short-staffed from Thanksgiving through December 31 as employees take time off to spend with family and friends. But if you limit how many vacation days employees can roll over to the new year, you might find your workplace a ghost town as workers scramble to use, rather than lose, their […]

Why making annual exclusion gifts before year end can still be a good idea

A tried-and-true estate planning strategy is to make tax-free gifts to loved ones during life, because it reduces potential estate tax at death. There are many ways to make tax-free gifts, but one of the simplest is to take advantage of the annual gift tax exclusion with direct gifts. Even in a potentially changing […]

2016 charitable donations offer both estate planning and income tax benefits

During the holiday season your thoughts likely turn to helping those in need by making charitable donations. Doing so will benefit your favorite organizations and help you achieve your estate planning goal of reducing the size of your taxable estate. In addition, by donating during your lifetime, rather than at death, you’ll receive an […]

Your company’s balance sheet makes great reading this time of year

Year end is just about here. You know what that means, right? It’s a great time to settle in by a roaring fire and catch up on reading … your company’s financial statements. One chapter worth a careful perusal is the balance sheet. Therein may lie some important lessons. 3 ratios to consider In […]

How to report discontinued operations today

Did your company undergo a major strategic shift in 2016? If so, management may need to comply with the updated rules for reporting discontinued operations that went into effect in 2015 for most companies. Discontinued operations typically don’t happen every year, so it’s important to review the basics before preparing your year-end financial statements. […]

Can you pay bonuses in 2017 but deduct them this year?

You may be aware of the rule that allows businesses to deduct bonuses employees have earned during a tax year if the bonuses are paid within 2½ months after the end of that year (by March 15 for a calendar-year company). But this favorable tax treatment isn’t always available. For one thing, only accrual-basis […]

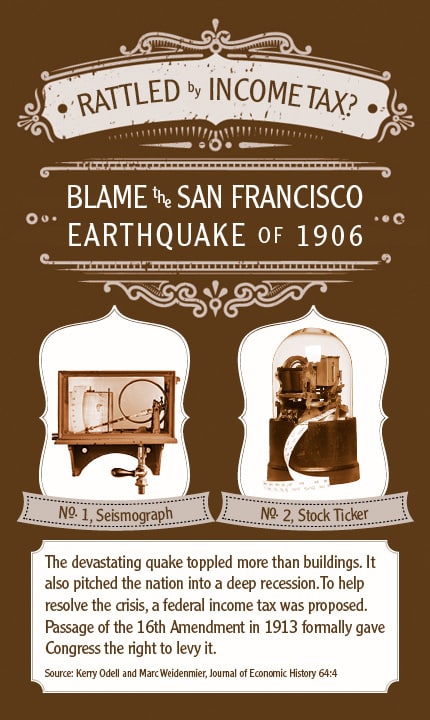

Rattled by Income Tax?