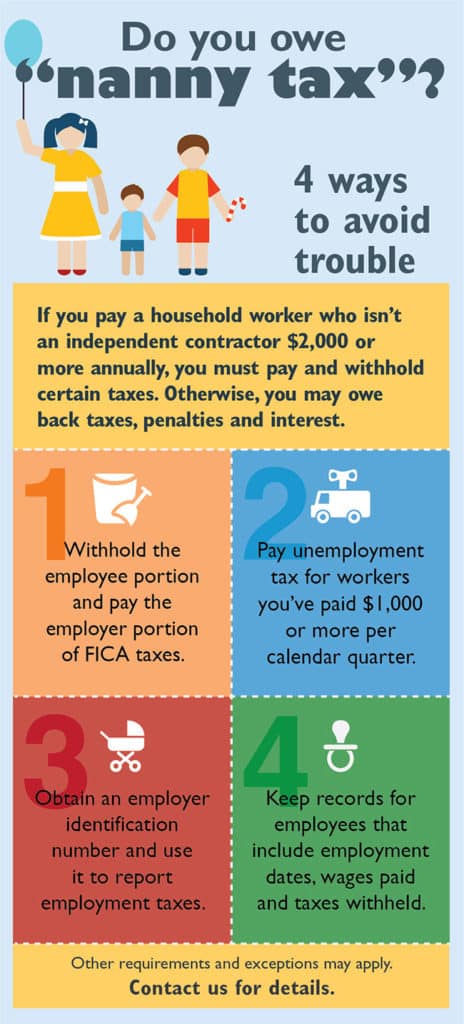

Do you owe “nanny tax”?

What you need to know about the tax treatment of ISOs

Incentive stock options allow you to buy company stock in the future at a fixed price equal to or greater than the stock’s fair market value on the grant date. If the stock appreciates, you can buy shares at a price below what they’re then trading for. However, complex tax rules apply to this type […]

2016 higher-education breaks can save your family taxes

Was a college student in your family last year? Or were you a student yourself? You may be eligible for some valuable tax breaks on your 2016 return. To max out your higher education breaks, you need to see which ones you’re eligible for and then claim the one(s) that will provide the greatest […]

5 questions single parents should ask about their estate plans

In many respects, estate planning for single parents of minor children is similar to estate planning for families with two parents. Single parents want to provide for their children’s care and financial needs after they’re gone. But when only one parent is involved, certain aspects of an estate plan demand special attention. If you’re […]

PTO banks: A smart HR solution for many companies

“I’m taking a sick day!” This familiar refrain usually is uttered with just cause, but not always. What if there were no sick days? No, we’re not suggesting employees be forced to work when they’re under the weather. Rather, many businesses are adopting a different paradigm when it comes to paid time off (PTO). […]

FASB approves one-step impairment test for goodwill

In January, the Financial Accounting Standards Board (FASB) issued updated guidance to simplify goodwill impairment testing for public companies and private companies that haven’t taken advantage of the simplified reporting option for goodwill. Here are the details. The basics Goodwill shows up on a company’s balance sheet when it buys another business at a […]

Why 2016 may be an especially good year to take bonus depreciation

Bonus depreciation allows businesses to recover the costs of depreciable property more quickly by claiming additional first-year depreciation for qualified assets. The PATH Act, signed into law a little over a year ago, extended 50% bonus depreciation through 2017. Claiming this break is generally beneficial, though in some cases a business might save more […]

Profiling occupational fraud perpetrators

The investment interest expense deduction: Less beneficial than you might think

Investment interest — interest on debt used to buy assets held for investment, such as margin debt used to buy securities — generally is deductible for both regular tax and alternative minimum tax purposes. But special rules apply that can make this itemized deduction less beneficial than you might think. Limits on the deduction […]

2 postmortem estate planning strategies for married couples

It’s crucial to review and update your estate plan in light of significant life changes or new tax laws. It’s equally important to be aware of strategies that can be implemented after your death to achieve your estate planning goals. The flexibility postmortem strategies provide is especially important during times of estate tax law […]