Workers age 50 and up: Boost retirement savings before year end with catch-up contributions

Whether you didn’t save as much for retirement as you would have wished earlier in your career or you’d simply like to make the most of tax-advantaged savings opportunities, if you’ll be age 50 or older on December 31, consider making “catch-up” contributions to your employer-sponsored retirement plan by that date. These are additional contributions […]

Relocating into or out of a community property state requires extra estate planning

When a married couple lives in a community property state, the money earned and property acquired by either spouse during their marriage generally belongs to the “community.” This means that each spouse has an undivided one-half interest in the property (regardless of how property is titled). Then, when one spouse dies, his or her […]

Family matters: Stepchildren and your estate plan

If you have unadopted stepchildren, estate planning is critical to ensure that your property is distributed the way you desire. Stepchildren generally don’t have any inheritance rights with respect to their parents’ new spouses unless the spouse legally adopts them. If you have stepchildren and want them to share in your estate, one option […]

Keeping your family business in the family

A successful family business can provide long-term financial security for you as its owner, as well as for your loved ones. To improve the chances that your company will continue to benefit your heirs after you’re gone, take steps now to keep it in the family. Staying in-house Careful estate planning can ensure that […]

Reporting UTPs

Navigating the tax code — and staying atop the latest tax law developments — can be challenging for business owners. In turn, financial reporting for uncertain tax positions (UTPs), such as pending IRS audits or lawsuits, is complicated and subjective. Here’s some guidance to help clarify matters. Applying the threshold Companies that follow U.S. […]

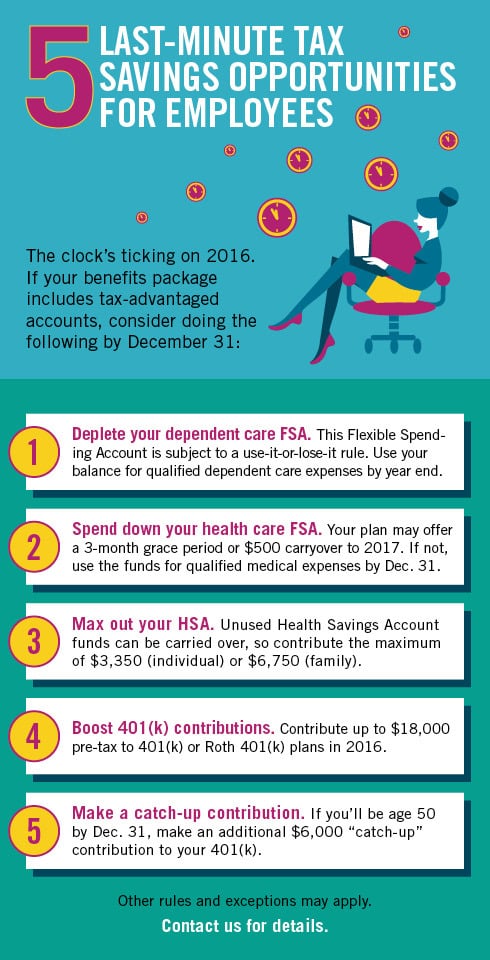

5 Last-minute tax savings opportunities

Ensure your year-end donations will be deductible on your 2016 return

Donations to qualified charities are generally fully deductible, and they may be the easiest deductible expense to time to your tax advantage. After all, you control exactly when and how much you give. To ensure your donations will be deductible on your 2016 return, you must make them by year end to qualified charities. […]

Could a tax-free exchange help cover LTC insurance costs?

No estate plan is complete without considering long-term care (LTC) expenses and how to pay for them. LTC insurance is an option, but these policies can be expensive. One solution is to use a total or partial tax-free exchange of an existing life insurance policy or annuity contract. Reviewing the history For many years, […]

Roth 401(k) conversions may suit your Millennial employees

Could your company’s benefits package use a bit of an upgrade? If so, one idea to consider is adding an option for employees to convert their regular 401(k)s to Roth 401(k)s. Under a Roth 401(k), participants make after-tax contributions to a qualified plan and receive tax-free distributions, provided the funds are in the plan […]

There’s still time to benefit on your 2016 tax bill by buying business assets

In order to take advantage of two important depreciation tax breaks for business assets, you must place the assets in service by the end of the tax year. So you still have time to act for 2016. Section 179 deduction The Sec. 179 deduction is valuable because it allows businesses to deduct as depreciation […]