MOVING ON! NOT WITHOUT A BUSINESS SUCCESSION PLAN

Bittersweet! Will new sugar taxes incite a second revolution?

Beware the GST tax when transferring assets to grandchildren

As you plan your estate, don’t overlook the generation-skipping transfer (GST) tax. Despite a generous $5.49 million GST tax exemption, complexities surrounding its allocation can create several tax traps for the unwary. GST basics The GST tax is a flat, 40% tax on transfers to “skip persons,” including grandchildren, other family members more than a […]

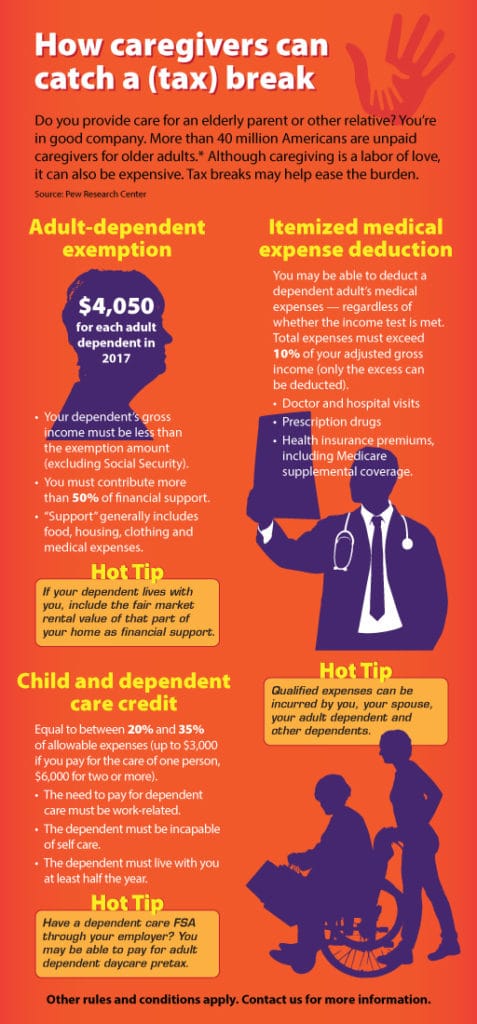

How caregivers can catch a (tax) break

Nonqualified stock options demand tax planning attention

Your compensation may take several forms, including salary, fringe benefits and bonuses. If you work for a corporation, you might also receive stock-based compensation, such as stock options. These come in two varieties: nonqualified (NQSOs) and incentive (ISOs). With both NQSOs and ISOs, if the stock appreciates beyond your exercise price, you can buy shares […]

3 midyear tax planning strategies for individuals

In the quest to reduce your tax bill, year end planning can only go so far. Tax-saving strategies take time to implement, so review your options now. Here are three strategies that can be more effective if you begin executing them midyear: 1. Consider your bracket The top income tax rate is 39.6% for taxpayers […]

Yes, you can undo a Roth IRA conversion

Converting a traditional IRA to a Roth IRA can provide tax-free growth and the ability to withdraw funds tax-free in retirement. But what if you convert a traditional IRA — subject to income taxes on all earnings and deductible contributions — and then discover that you would have been better off if you hadn’t converted […]

How to determine if you need to worry about estate taxes

Among the taxes that are being considered for repeal as part of tax reform legislation is the estate tax. This tax applies to transfers of wealth at death, hence why it’s commonly referred to as the “death tax.” Its sibling, the gift tax — also being considered for repeal — applies to transfers during life. […]

Will Congress revive expired tax breaks?

Most of the talk about possible tax legislation this year has focused on either wide-sweeping tax reform or taxes that are part of the Affordable Care Act. But there are a few other potential tax developments for individuals to keep an eye on. Back in December of 2015, Congress passed the PATH Act, which made […]

ABLE accounts can benefit loved ones with special needs

For families with disabled family members who’re potentially eligible for means-tested government benefits such as Medicaid or Supplemental Security Income (SSI), estate planning can be a challenge. On the one hand, you want to provide the most comfortable life possible for your loved one. On the other hand, you don’t want to jeopardize his or […]