Are you familiar with fraudulent transfer laws?

A primary goal of your estate plan is to transfer wealth to your family according to your wishes and at the lowest possible tax cost. However, if you have creditors, be aware of fraudulent transfer laws. In a nutshell, if your creditors challenge your gifts, trusts or other strategies as fraudulent transfers, they can quickly […]

Why business owners should regularly upgrade their accounting software

Many business owners buy accounting software and, even if the installation goes well, eventually grow frustrated when they don’t get the return on investment they’d expected. There’s a simple reason for this: Stuff changes. Technological improvements are occurring at a breakneck speed. So yesterday’s cutting-edge system can quickly become today’s sluggishly performing albatross. And […]

You don’t have to take business insurance costs sitting down

Adequate insurance coverage is, in many cases, a legal requirement for a business. Even if it’s not for your company, proper coverage remains a risk management imperative. But that doesn’t mean you have to take high insurance costs sitting down. There are a wide variety of ways you can decrease insurance costs. Just two […]

Seasonal business? Optimize your operating cycle

Every business has some degree of ups and downs during the year. But cash flow fluctuations are much more intense for seasonal businesses. So, if your company defines itself as such, it’s important to optimize your operating cycle to anticipate and minimize shortfalls. A high-growth example To illustrate: Consider a manufacturer and distributor of […]

Respecting auditor independence

Auditor independence is still a hot topic among investors and lenders even though the financial crisis of 2008 was nine years ago. Here’s an overview of the independence guidance from the Securities and Exchange Commission (SEC). These rules apply specifically to public companies, but auditors of private companies are typically held to the same […]

Pay attention to the details when selling investments

The tax consequences of the sale of an investment, as well as your net return, can be affected by a variety of factors. You’re probably focused on factors such as how much you paid for the investment vs. how much you’re selling it for, whether you held the investment long-term (more than one year) and […]

Are income taxes taking a bite out of your trusts?

If your estate plan includes one or more trusts, review them in light of income taxes. For trusts, the income threshold is very low for triggering the: Top income tax rate of 39.6%, Top long-term capital gains rate of 20%, and Net investment income tax (NIIT) of 3.8%. The threshold is only $12,500 for 2017. […]

Wouldn’t you rather be doing something – anything – besides the books?

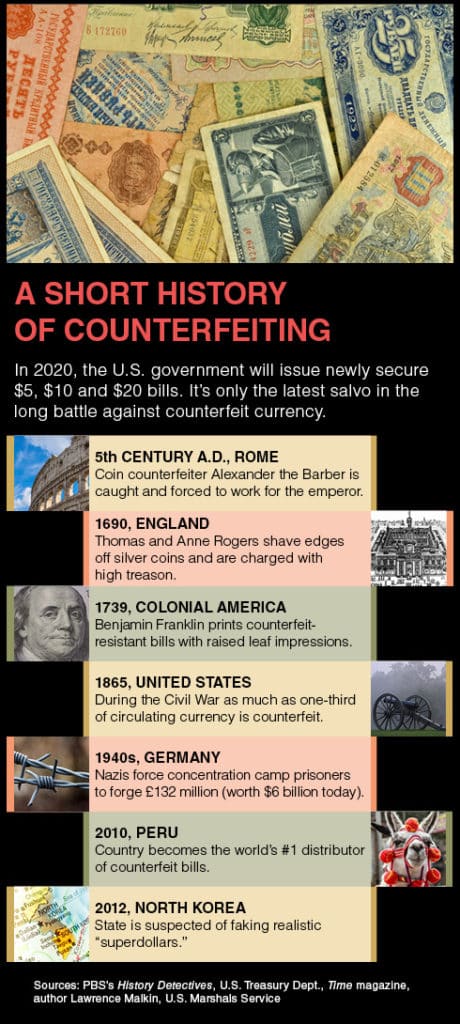

A Short History of Counterfeiting

Choosing the best way to reimburse employee travel expenses

If your employees incur work-related travel expenses, you can better attract and retain the best talent by reimbursing these expenses. But to secure tax-advantaged treatment for your business and your employees, it’s critical to comply with IRS rules. Reasons to reimburse While unreimbursed work-related travel expenses generally are deductible on a taxpayer’s individual tax […]