Deduct all of the mileage you’re entitled to — but not more

Rather than keeping track of the actual cost of operating a vehicle, employees and self-employed taxpayers can use a standard mileage rate to compute their deduction related to using a vehicle for business. But you might also be able to deduct miles driven for other purposes, including medical, moving and charitable purposes. What are the […]

Are you leaving your IRA to someone other than your spouse?

An IRA can be a powerful wealth-building tool, offering tax-deferred growth (tax-free in the case of a Roth IRA), asset protection and other benefits. But if you leave an IRA to your children — or to someone else other than your spouse — these benefits can be lost without careful planning. “Inherited IRA” stretches tax […]

What can a valuation expert do for your succession plan?

Most business owners spend a lifetime building their business. And when it comes to succession, they face the difficult decision of whether to sell, dissolve or transfer the business to family members (or a nonfamily successor). Many complicated issues are involved, including how to divvy up business interests, allocate value and tackle complex tax […]

IFRS vs. GAAP: Some public companies want a choice

U.S. public companies are required to report their financial results using U.S. Generally Accepted Accounting Principles (GAAP). But, since 2007, hundreds of foreign companies listed on U.S. stock markets have been able to report financial results using International Financial Reporting Standards (IFRS) instead of GAAP. The Securities and Exchange Commission (SEC) is currently considering […]

An EAP can keep your top players on the floor

A good basketball team is at its best when its top players are on the floor. Similarly, a company is the most productive, efficient and innovative when its best employees are in the right positions, doing great work. Unfortunately, it’s not uncommon for good employees to battle personal problems, such as substance dependence, financial […]

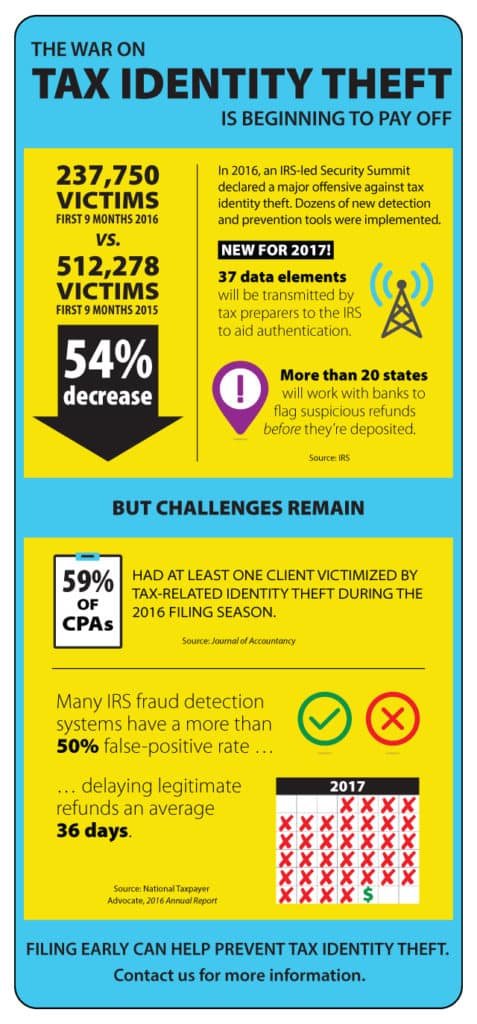

The War on Tax Identity Theft

SEPs: A powerful retroactive tax planning tool

Simplified Employee Pensions (SEPs) are sometimes regarded as the “no-brainer” first choice for high-income small-business owners who don’t currently have tax-advantaged retirement plans set up for themselves. Why? Unlike other types of retirement plans, a SEP is easy to establish and a powerful retroactive tax planning tool: The deadline for setting up a SEP […]

Honest, Abe, Indeed!

Do you need to file a 2016 gift tax return by April 18?

Last year you may have made significant gifts to your children, grandchildren or other heirs as part of your estate planning strategy. Or perhaps you just wanted to provide loved ones with some helpful financial support. Regardless of the reason for making a gift, it’s important to know under what circumstances you’re required to file […]

2016 charitable deductions: Substantiate them or lose them

Sharing your wealth with a favorite charity can benefit those in need and reduce your taxable estate. In addition, your donations can ease your income tax liability. But you must meet IRS substantiation requirements. If you fail to do so, the IRS could deny the corresponding deductions you’re claiming. Let’s take a look at the […]