Envision your advisory board before you form it

Many companies reach a point in their development where they could benefit from an advisory board. It’s all too easy in today’s complex business world to get caught up in an “echo chamber” of ideas and perspectives that only originate internally. For many business owners, an understandable first question about the concept is: What […]

Is annual financial reporting enough?

Businesses generally issue year-end financial statements to let investors and lenders evaluate their financial health. But proactive stakeholders — including the company’s CEO and board of directors — may want more than one “snapshot” per year of financial results. Interim statements let stakeholders know how a company is doing each quarter or month, but […]

Take small-business tax credits where credits are due

Tax credits reduce tax liability dollar-for-dollar, making them particularly valuable. Two available credits are especially for small businesses that provide certain employee benefits. And one of them might not be available after 2017. 1. Small-business health care credit The Affordable Care Act (ACA) offers a credit to certain small employers that provide employees with […]

The “manufacturers’ deduction” isn’t just for manufacturers

The Section 199 deduction is intended to encourage domestic manufacturing. In fact, it’s often referred to as the “manufacturers’ deduction.” But this potentially valuable tax break can be used by many other types of businesses besides manufacturing companies. Sec. 199 deduction 101 The Sec. 199 deduction, also called the “domestic production activities deduction,” is […]

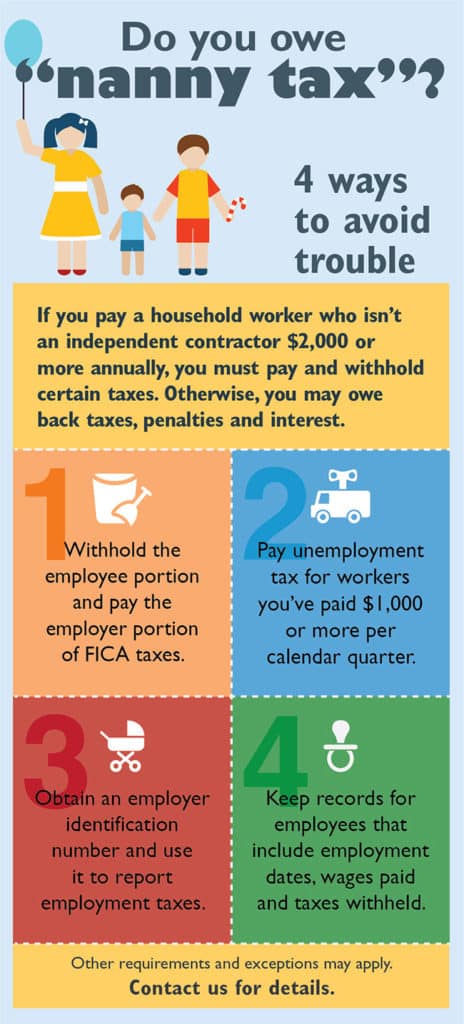

Do you owe “nanny tax”?

What you need to know about the tax treatment of ISOs

Incentive stock options allow you to buy company stock in the future at a fixed price equal to or greater than the stock’s fair market value on the grant date. If the stock appreciates, you can buy shares at a price below what they’re then trading for. However, complex tax rules apply to this type […]

2016 higher-education breaks can save your family taxes

Was a college student in your family last year? Or were you a student yourself? You may be eligible for some valuable tax breaks on your 2016 return. To max out your higher education breaks, you need to see which ones you’re eligible for and then claim the one(s) that will provide the greatest […]

5 questions single parents should ask about their estate plans

In many respects, estate planning for single parents of minor children is similar to estate planning for families with two parents. Single parents want to provide for their children’s care and financial needs after they’re gone. But when only one parent is involved, certain aspects of an estate plan demand special attention. If you’re […]

PTO banks: A smart HR solution for many companies

“I’m taking a sick day!” This familiar refrain usually is uttered with just cause, but not always. What if there were no sick days? No, we’re not suggesting employees be forced to work when they’re under the weather. Rather, many businesses are adopting a different paradigm when it comes to paid time off (PTO). […]

FASB approves one-step impairment test for goodwill

In January, the Financial Accounting Standards Board (FASB) issued updated guidance to simplify goodwill impairment testing for public companies and private companies that haven’t taken advantage of the simplified reporting option for goodwill. Here are the details. The basics Goodwill shows up on a company’s balance sheet when it buys another business at a […]