Why 2016 may be an especially good year to take bonus depreciation

Bonus depreciation allows businesses to recover the costs of depreciable property more quickly by claiming additional first-year depreciation for qualified assets. The PATH Act, signed into law a little over a year ago, extended 50% bonus depreciation through 2017. Claiming this break is generally beneficial, though in some cases a business might save more […]

Profiling occupational fraud perpetrators

The investment interest expense deduction: Less beneficial than you might think

Investment interest — interest on debt used to buy assets held for investment, such as margin debt used to buy securities — generally is deductible for both regular tax and alternative minimum tax purposes. But special rules apply that can make this itemized deduction less beneficial than you might think. Limits on the deduction […]

2 postmortem estate planning strategies for married couples

It’s crucial to review and update your estate plan in light of significant life changes or new tax laws. It’s equally important to be aware of strategies that can be implemented after your death to achieve your estate planning goals. The flexibility postmortem strategies provide is especially important during times of estate tax law […]

Is your business committed to its cost-control regimen?

At the beginning of the year, many people decide they’re going to get in the best shape of their lives. Similarly, many business owners declare that they intend to cut costs and operate at peak efficiency going forward. But, like keeping up an exercise routine, controlling costs takes an ongoing effort. You need to […]

Ready, set, audit

If your business issues audited financial statements and follows a calendar year end, your external auditing procedures have already begun. At a minimum, you’ve signed an engagement letter, sent over preliminary financial statements and allowed your CPA to observe any year end physical inventory counts. But there are some steps you can still take […]

Deduction for state and local sales tax benefits some, but not all, taxpayers

The break allowing taxpayers to take an itemized deduction for state and local sales taxes in lieu of state and local income taxes was made “permanent” a little over a year ago. This break can be valuable to those residing in states with no or low income taxes or who purchase major items, such […]

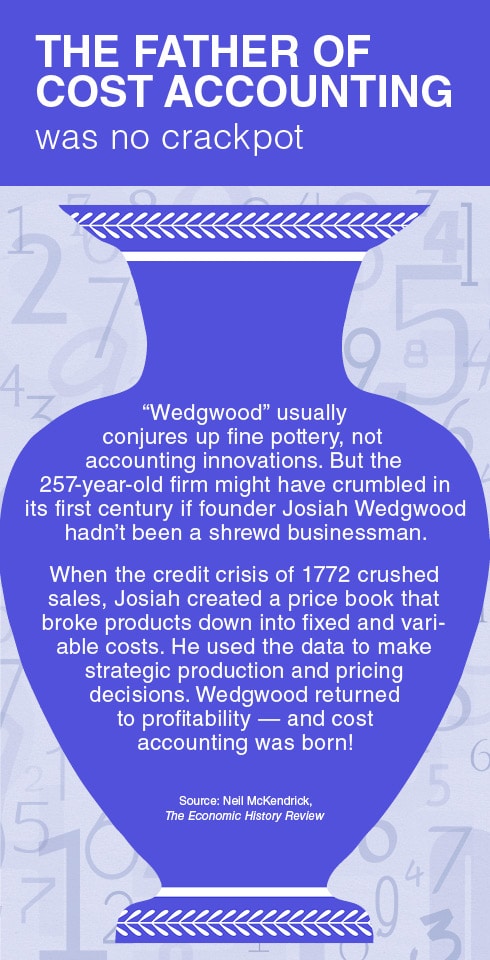

The Father of Cost Accounting

Withhold tax from my paycheck?

Can you defer taxes on advance payments?

Many businesses receive payment in advance for goods and services. Examples include magazine subscriptions, long-term supply contracts, organization memberships, computer software licenses and gift cards. Generally, advance payments are included in taxable income in the year they’re received, even if you defer a portion of the income for financial reporting purposes. But there are […]