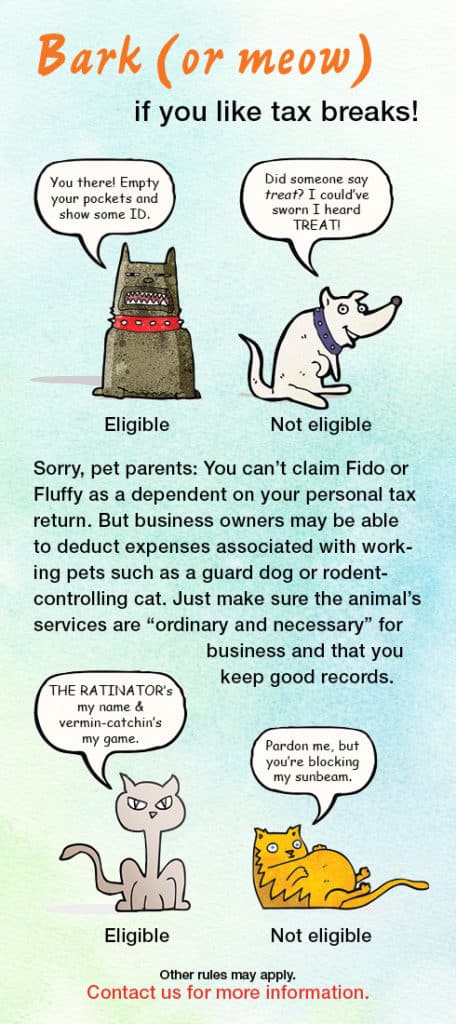

Bark (or meow) if you like tax breaks!

Help prevent tax identity theft by filing early

If you’re like many Americans, you might not start thinking about filing your tax return until close to this year’s April 18 deadline. You might even want to file for an extension so you don’t have to send your return to the IRS until October 16. But there’s another date you should keep in […]

Should you set up trusts in a more “trust-friendly” state?

While it’s natural to set up trusts in the state where you live, you may be losing out on significant benefits available in more “trust-friendly” states. For example, some states: • Don’t tax trust income, • Authorize domestic asset protection trusts, which provide added protection against creditors’ claims, • Permit silent trusts, under which […]

Succession planning and estate planning must go hand in hand

As the saying goes, nothing lasts forever — and that goes for most companies. Then again, with the right succession plan in place, you can do your part to ensure your business continues down a path of success for at least another generation. From there, it will be your successor’s job to propel it […]

What is a business?

Differentiating the purchase of a business from the purchase of a group of assets is something that the Financial Accounting Standards Board (FASB) has been debating for years. In January 2017, the board finally published guidance to help financial executives and accountants define what a business is in the context of a business combination. […]

Can you spot the independent contractor?

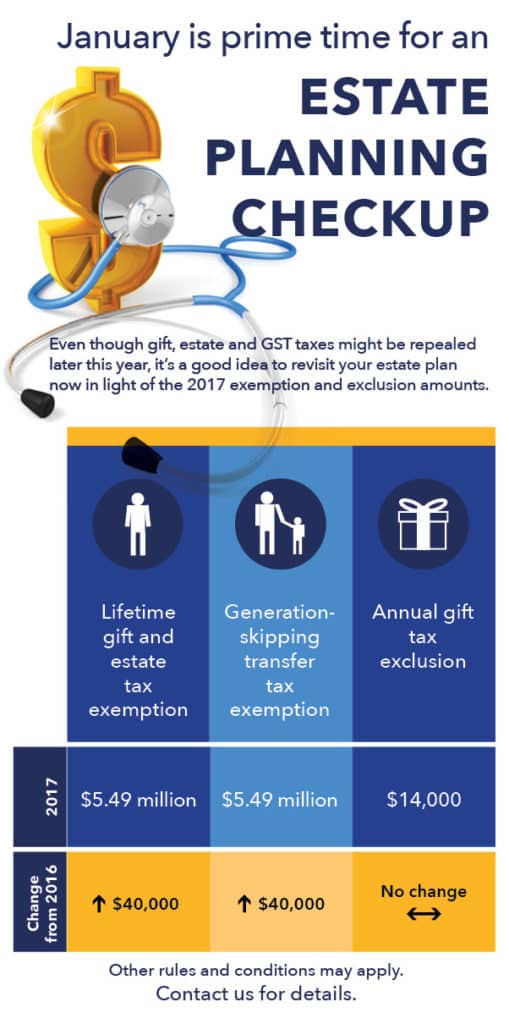

January is prime time for an Estate Planning Checkup

Are you able to deduct medical expenses on your tax return?

For many people, the cost of medical care keeps going up. So if possible, you should find ways to claim tax breaks related to health care. Unfortunately, it can be difficult because there’s a threshold for deducting itemized medical expenses that can be tough to meet. To make matters worse, the threshold for senior […]

Explore all of your options when appointing the executor of your estate

The executor’s role is critical to the administration of an estate and the achievement of estate planning objectives. So your first instinct may be to name a trusted family member as executor (also referred to as a personal representative). But that might not be the best choice. Important duties Your executor has a variety […]

Going back to basics with asset protection strategies

Asset protection trusts — both offshore and domestic — can be effective vehicles for protecting your wealth in today’s litigious society. But these trusts can be complex and expensive, so they’re not right for everyone. For those seeking simpler asset protection strategies, there are several basic, yet effective, tools to consider. Some of these […]