Make health care decisions while you’re healthy

Estate planning isn’t just about what happens to your assets after you die. It’s also about protecting yourself and your loved ones. This includes having a plan for making critical medical decisions in the event you’re unable to make them yourself. And, as with other aspects of your estate plan, the time to act is […]

Listen and trust: The power of collaborative management

Many business owners are accustomed to running the whole show. But as your company grows, you’ll likely be better off sharing responsibility for major decisions. Whether you’ve recruited experienced managers or developed “home grown” talent, you can empower these employees by taking a more collaborative approach to management. Not employees — team members Successful […]

Cooking the books

What’s the most costly type of white collar crime? On average, a company is likely to lose more money from a scheme in which the financial statements are falsified or manipulated than from any other type of occupational fraud incident. The costs frequently include more than just the loss of assets — victimized companies […]

Tangible property safe harbors help maximize deductions

If last year your business made repairs to tangible property, such as buildings, machinery, equipment or vehicles, you may be eligible for a valuable deduction on your 2016 income tax return. But you must make sure they were truly “repairs,” and not actually “improvements.” Why? Costs incurred to improve tangible property must be depreciated […]

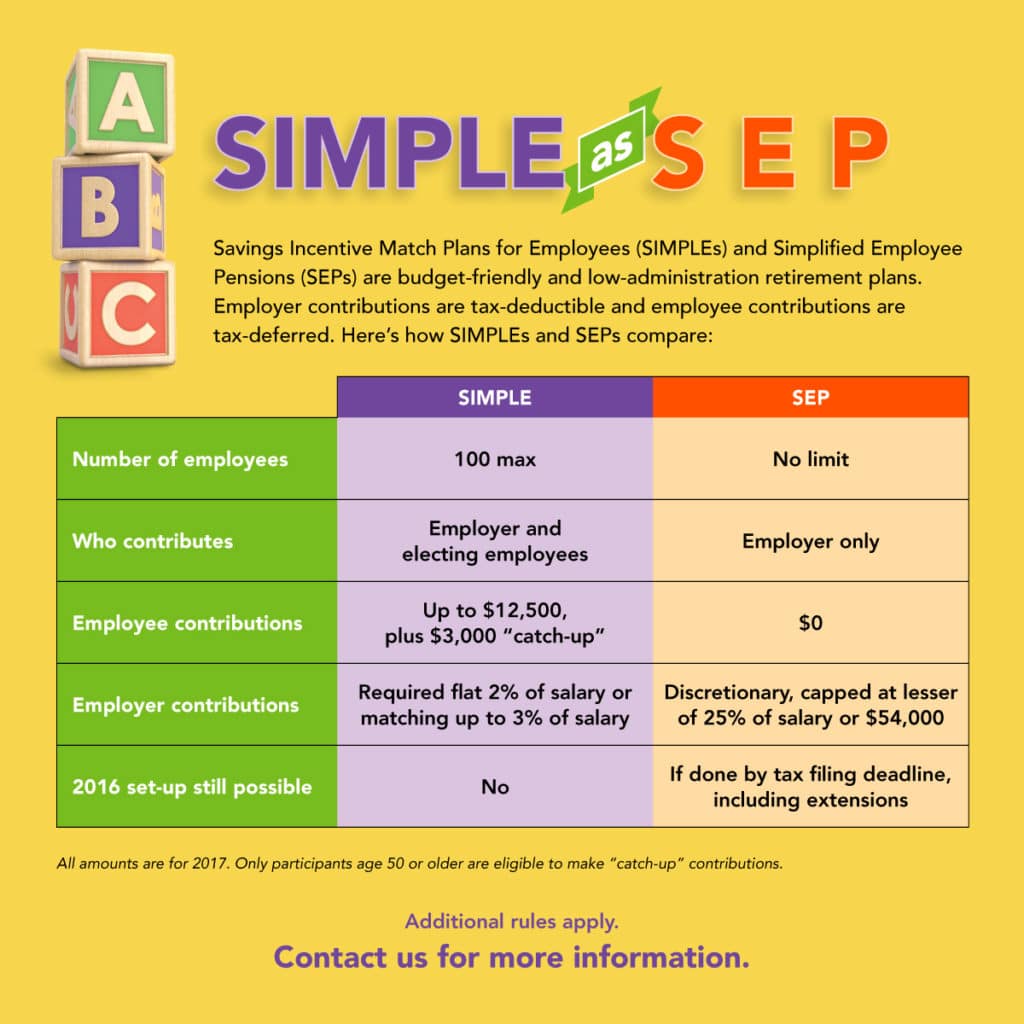

SIMPLE vs SEP

When it comes to charitable deductions, all donations aren’t created equal

As you file your 2016 return and plan your charitable giving for 2017, it’s important to keep in mind the available deduction. It can vary significantly depending on a variety of factors. What you give Other than the actual amount you donate, one of the biggest factors that can affect your deduction is what you […]

Use an ILIT as a wealth preserver

If you’re concerned about your family’s financial well-being after you’re gone, life insurance can provide peace of mind. Going a step further and setting up an irrevocable life insurance trust (ILIT) to hold the policy offers additional estate planning benefits. Asset protection If you’re concerned about your heirs’ money management skills, an ILIT may be […]

Don’t make hunches — crunch the numbers

Some business owners make major decisions by relying on gut instinct. But investments made on a “hunch” often fall short of management’s expectations. In the broadest sense, you’re really trying to answer a simple question: If my company buys a given asset, will the asset’s benefits be greater than its cost? The good news […]

Can the WOTC save tax for your business?

Employers that hire individuals who are members of a “target group” may be eligible for the Work Opportunity tax credit (WOTC). If you made qualifying hires in 2016 and obtained proper certification, you can claim the WOTC on your 2016 tax return. Whether or not you’re eligible for 2016, keep the WOTC in mind […]

Some customers are a real drag