Reporting UTPs

Navigating the tax code — and staying atop the latest tax law developments — can be challenging for business owners. In turn, financial reporting for uncertain tax positions (UTPs), such as pending IRS audits or lawsuits, is complicated and subjective. Here’s some guidance to help clarify matters. Applying the threshold Companies that follow U.S. […]

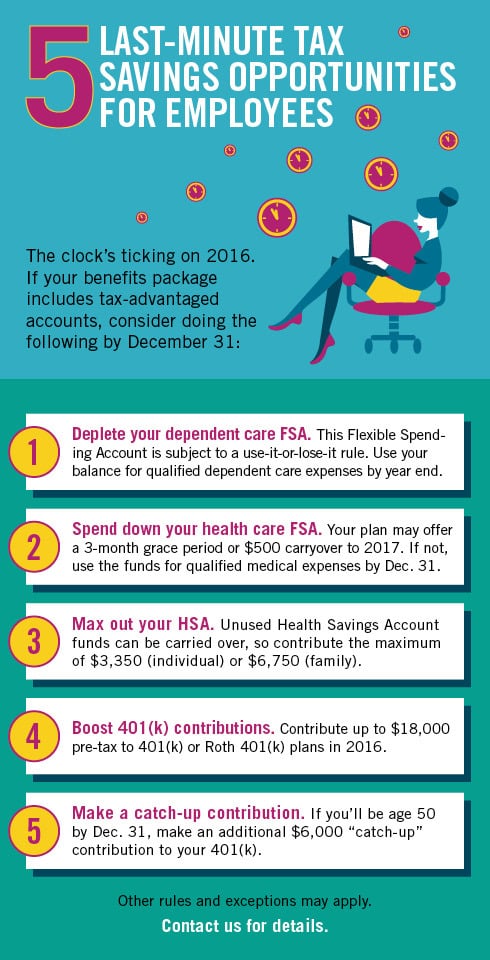

5 Last-minute tax savings opportunities

Ensure your year-end donations will be deductible on your 2016 return

Donations to qualified charities are generally fully deductible, and they may be the easiest deductible expense to time to your tax advantage. After all, you control exactly when and how much you give. To ensure your donations will be deductible on your 2016 return, you must make them by year end to qualified charities. […]

Could a tax-free exchange help cover LTC insurance costs?

No estate plan is complete without considering long-term care (LTC) expenses and how to pay for them. LTC insurance is an option, but these policies can be expensive. One solution is to use a total or partial tax-free exchange of an existing life insurance policy or annuity contract. Reviewing the history For many years, […]

Roth 401(k) conversions may suit your Millennial employees

Could your company’s benefits package use a bit of an upgrade? If so, one idea to consider is adding an option for employees to convert their regular 401(k)s to Roth 401(k)s. Under a Roth 401(k), participants make after-tax contributions to a qualified plan and receive tax-free distributions, provided the funds are in the plan […]

There’s still time to benefit on your 2016 tax bill by buying business assets

In order to take advantage of two important depreciation tax breaks for business assets, you must place the assets in service by the end of the tax year. So you still have time to act for 2016. Section 179 deduction The Sec. 179 deduction is valuable because it allows businesses to deduct as depreciation […]

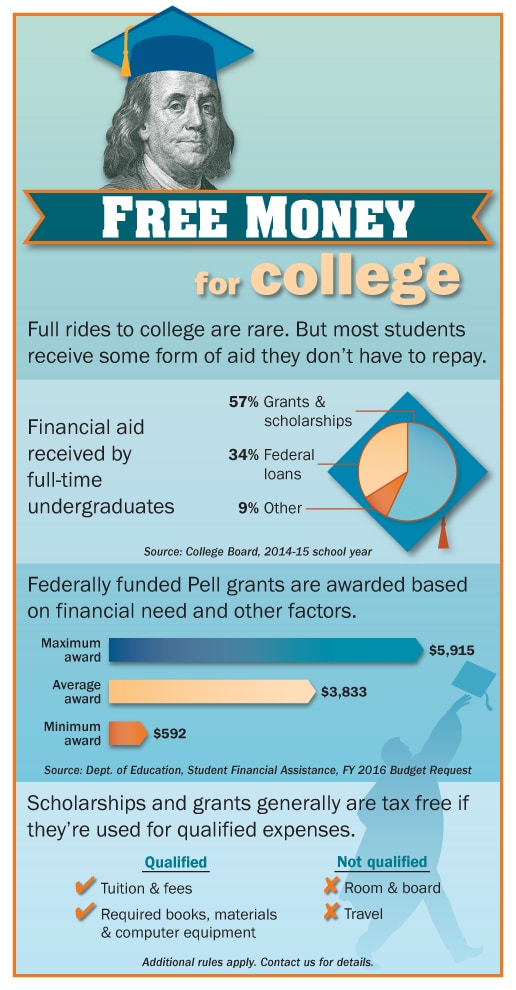

Free money for college

Setting sail into the global marketplace

For many of today’s companies, going global seems like a quick and trouble-free growth strategy. Technological advances and expansive supply chains make doing so easier than ever. But business owners who make this move impetuously may soon find themselves on stormy seas, taking on waves of debt and unanticipated expenses. Chart your course carefully […]

Should you keep your trust a secret?

When planning their estates, many people agonize over the negative impact their wealth might have on their children. To address these concerns, some people establish quiet trusts, also known as silent trusts. In other words, they leave significant sums in trust for their children; they just don’t tell them about it. An interesting approach, […]

Year-end tax strategies for accrual-basis taxpayers

The last month or so of the year offers accrual-basis taxpayers an opportunity to make some timely moves that might enable them to save money on their 2016 tax bill. Record and recognize The key to saving tax as an accrual-basis taxpayer is to properly record and recognize expenses that were incurred this year […]