Also, the smartest.

Individual tax calendar: Key deadlines for the remainder of 2017

While April 15 (April 18 this year) is the main tax deadline on most individual taxpayers’ minds, there are others through the rest of the year that are important to be aware of. To help you make sure you don’t miss any important 2017 deadlines, here’s a look at when some key tax-related forms, payments […]

A timely postmark on your tax return may not be enough to avoid late-filing penalties

Because of a weekend and a Washington, D.C., holiday, the 2016 tax return filing deadline for individual taxpayers is Tuesday, April 18. The IRS considers a paper return that’s due April 18 to be timely filed if it’s postmarked by midnight. But dropping your return in a mailbox on the 18th may not be […]

Acquaint yourself with the Roth IRA as an estate planning tool

A Roth IRA can be a valuable estate planning tool, offering the opportunity for tax-free growth as long as it exists and requiring no distributions during your life, thus allowing you to pass on a greater amount of wealth to your family. While traditional IRAs are more common, there’s no time like the present to […]

Look at your employees with cybersecurity in mind

Today’s businesses operate in an era of hyper-connectedness and, unfortunately, a burgeoning global cybercrime industry. You can’t afford to hope you’ll luck out and avoid a cyberattack. It’s essential to establish policies and procedures to minimize risk. One specific area on which to focus is your employees. Know the threats There are a variety […]

Benchmarking receivables

Accounts receivable represents a major asset for many companies. But how do your company’s receivables compare to others? Here’s the skinny on receivables ratios, including how they’re computed and sources of potential benchmarking data. Starting point A logical starting point for evaluating the quality of receivables is the days sales outstanding (DSO) ratio. This […]

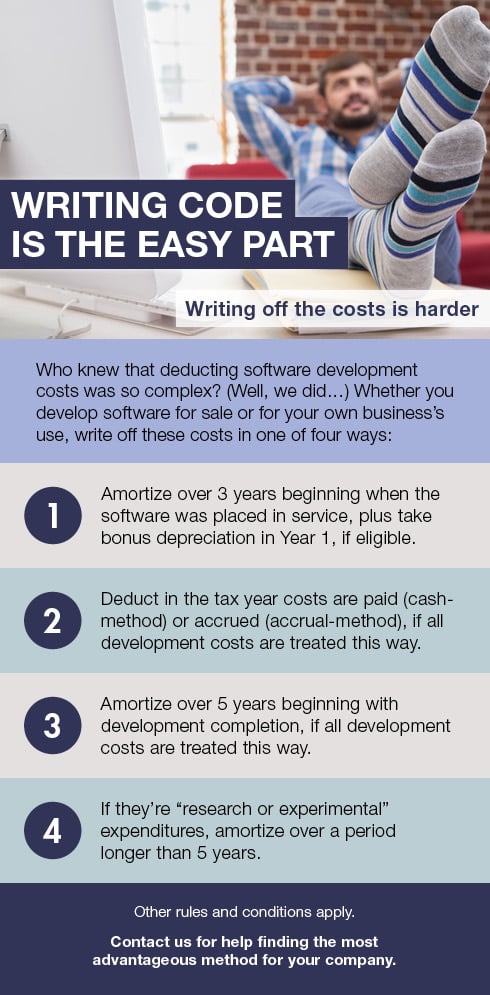

WRITING CODE IS THE EASY PART

Saving tax with home-related deductions and exclusions

Currently, home ownership comes with many tax-saving opportunities. Consider both deductions and exclusions when you’re filing your 2016 return and tax planning for 2017: Property tax deduction. Property tax is generally fully deductible — unless you’re subject to the alternative minimum tax (AMT). Mortgage interest deduction. You generally can deduct interest on up to […]

Be aware of the ins and outs of holding joint title to property

Owning assets jointly with one or more children or other heirs is a common estate planning “shortcut.” But like many shortcuts, it can produce unintended — and costly — consequences. Advantages There are two potential advantages to joint ownership: convenience and probate avoidance. If you hold title to property with a child as joint […]

Matchmaker, matchmaker: Choosing the right lender

It’s easy to think of lenders as doing your company a favor. But business financing relationships are just that: relationships. Yes, a lender has the working capital you need to grow. But a stable, successful business represents an enormously beneficial opportunity for the lender as well. So you should be just as picky with […]